RMGs are guidance documents. The purpose of an RMG is to support PGPA Act entities and companies in meeting the requirements of the PGPA framework. As guides, RMGs explain the legislation and policy requirements in plain English. RMGs support accountable authorities and officials to apply the intent of the framework. It is an official’s responsibility to ensure that Finance guidance is monitored regularly for updates, including changes in policy/requirements.

Audience

This Resource Management Guide (RMG) applies to all officials involved in resource management and the expenditure of Commonwealth moneys (e.g. accountable authorities, chief financial officers, officers with spending delegations, finance teams etc).

Key points

This RMG provides a point of reference for information on Commonwealth appropriations, appropriation Acts and related issues and outlines the Constitutional basis for appropriations, particularly that:

- all revenues or moneys raised or received by government shall form one Consolidated Revenue Fund (CRF)

- no money shall be drawn from the CRF except under an appropriation made by law.

The purpose of this RMG is to provide entity officials with information to support their understanding of appropriation Acts, associated Acts and rules that apply to establishing and amending appropriations, and how these underpin the rules and processes for expending Commonwealth money. This guide:

- summarises the relationship between appropriations and the Budget process

- explains the different types of appropriations and how they are created, increased or decreased

- demonstrates how breaches of the Constitution can occur when spending public money and explains how they can be avoided

- provides information on how the Goods and Services Tax (GST) impacts appropriations.

Introduction

The Commonwealth of Australia Constitution Act (the Constitution) is the foundational law of Australia. Under the Constitution:

- all revenues or moneys raised or received by the Commonwealth shall form one Consolidated Revenue Fund (CRF), to be appropriated for the purposes of the Commonwealth, in the manner prescribed by the Constitution

- no money is to be drawn from the CRF except under an appropriation made by law. Drawing money from the CRF without a valid appropriation in law would breach the Constitution (section 83).

There are two main categories of appropriations:

- annual appropriations - a provision within an annual appropriation Act or a supply Act, that provides annual funding to entities and Commonwealth companies to undertake ongoing government activities and programs

- special appropriations - a provision within an Act (that is not an annual appropriation Act or a supply Act) that provides authority to spend money for particular purposes (e.g. to finance a particular project or to make social security payments). Special accounts are a subset of special appropriations.

While appropriation Acts authorise the drawing of money from the CRF, they do not authorise the spending of that money. With limited exceptions, additional legislative authority and constitutional support are required for the Commonwealth to enter into arrangements to spend relevant money for a particular purpose, in addition to an appropriation.

Approval to spend relevant Commonwealth money can only be given, where there is available unspent appropriation.

Officials must ensure that commitments and spending are authorised in accordance with the relevant accountability and internal controls of their entity and any other laws.

Part 1 – Constitutional background

The Constitution provides the basic rules for the governance of Australia. It is the foundational law of Australia. An Act passed by parliament is invalid if it is contrary to the Constitution.

Sections 81 and 83 of the Constitution set out the rules for the payment of money made by the Commonwealth:

- section 81 provides that all revenues or moneys raised or received by the Executive Government of the Commonwealth shall form one CRF, to be appropriated for the purposes of the Commonwealth, in the manner prescribed by the Constitution

- section 83 provides that no money shall be drawn from the Treasury of the Commonwealth (the Treasury) except under an appropriation made by law.

‘The Treasury’, referred to in section 81, equates to the CRF. This effectively means that the CRF is the ‘public purse’ of parliament in that:

- all money received by, or on behalf of, the Commonwealth (i.e. taxes, charges, levies, borrowings, loan repayments and money held in trust etc), whether or not it is credited to a fund or bank account, forms part of the CRF

- money cannot be drawn from the CRF without an appropriation Act.

The Constitution also sets the rules for the passage of appropriation Bills (i.e. proposals for appropriation Acts) through parliament, for the ordinary annual services of the government. Under sections 53 and 54 of the Constitution:

- section 53 sets out the limitations on the power of the Australian Senate with respect to financial legislation and provides that the Senate may not amend Bills appropriating money for the ordinary annual services of the government

- section 54 provides that a bill appropriating money for the ordinary annual services of the government can only deal with such appropriations.

As noted in Infosheet 7 – Making laws this effectively means that, in some respects, the legislative powers of the 2 Houses of the federal parliament are not equal. In matters that relate to the collection or expenditure of public money the Constitution gives a more powerful role to the House of Representatives.

Bills to authorise appropriations from the CRF (i.e. appropriation Bills) and Bills to impose taxation cannot originate from the Senate. The Senate cannot amend Bills to impose taxation and some kinds of appropriation Bills, and cannot amend any Bill so as to increase any ‘proposed charge or burden on the people’. However, the Senate can ask the House of Representatives to make amendments to such Bills.

Appropriation Acts

Appropriation Acts perform an important constitutional function. These are the laws of parliament that authorise the withdrawal of money from the CRF, for the purposes specified in the appropriation Act. Appropriation Acts do not create rights to expenditure, nor do they impose any duties.

An Act that does not include the word ‘appropriation’ in its title, may still be an appropriation Act. An appropriation Act is any Act that:

- includes an appropriation and creates authority for expenditure from the CRF, or

- would have the effect of increasing, altering the destination of, or extending the purpose of an already existing appropriation.

As appropriation Acts are laws, they take precedence over details in the Central Budget Management System (CBMS), Portfolio Budget Statements (PB Statements), Portfolio Additional Estimates Statements (PAES) and entity annual reports.

While appropriation Acts authorise the drawing of cash from the CRF, they do not authorise the spending of that cash. With limited exceptions, additional legislative authority is needed to provide the power for the Commonwealth to enter into arrangements and spend relevant money. The High Court has determined that additional legislative authority is necessary for spending other than on the ‘ordinary and well-recognised’ functions of government, and the spending must be supported by a head of power that is in the Constitution. The High Court held that these requirements must be met, in addition to an appropriation.

Sources of legislative authority to spend relevant money may include:

- specific provisions in the primary legislation administered by a portfolio

- section 32B of the Financial Framework (Supplementary Powers) Act 1997 (FF(SP) Act), which provides the Commonwealth with the power to:

- make, vary and administer arrangements, grants and financial assistance specified in the Financial Framework (Supplementary Powers) Regulations 1997 (the FF(SP) Regulations)

- make, vary and administer arrangements for the purposes of programs specified in the FF(SP) Regulations. Schedules 1AA and 1AB to the FF(SP) Regulations specify the arrangements, grants, financial assistance and programs.

Commonwealth entities should seek advice from the Australian Government Solicitor (AGS) about constitutional support and legislative authority for proposed spending.

Approval to spend relevant money can only be given if there is an available appropriation. Spending approval must be made in accordance with relevant laws and internal controls of the entity, including:

- the accountable authority instructions (AAIs), which promote the proper use and management of public resources in accordance with section 15(1)(a) of the Public Governance, Performance and Accountability Act 2013 (PGPA Act)

- financial delegations that provide the legal authority to exercise certain powers and functions under section 23 of the PGPA Act and/or section 32B of the FF(SP) Act

- the entity’s decision-making processes for the proper use of public resources including decision-making and control processes for the expenditure of relevant money.

Government decisions identify the type of appropriation to be used to fund an initiative. The two main types of Acts containing appropriations are:

- annual appropriation Acts - provide a limited amount of funding from the CRF to meet expenses in a specific year. Unspent annual appropriations do not lapse at the end of each financial year but continue to be available to entities until the relevant amount is fully expended, or until the repeal date for the annual appropriation Act as specified in that Act.

- Acts that include special appropriations - are Acts (other than annual appropriation Acts) that contain one or more provisions that appropriate funding from the CRF for a particular purpose (e.g. to make social security payments or to fund a particular project). Special appropriations are often not specific in amount or duration.

Part 2 – The Budget cycle

In Australia, the financial year runs from 1 July to 30 June. In the same way as private businesses, the government prepares budgets based on their expected activities for the next financial year, and reports on estimated actual expenditure for the current or immediately preceding year.

The Budget is the government’s annual statement of how it plans to collect and spend money. The Budget is introduced into parliament as a collection of Bills (proposed laws) called appropriation Bills. These Bills aim to appropriate public money. The government collects money from several sources, including:

- taxes on incomes (wages and company profits), excise (on goods made and/or sold within the country) and customs duties (on imported or exported goods)

- charges (e.g. the Queensland flood levy and the Medicare levy)

- selling government assets.

The government uses this money to pay for running the country, including funding things like the Australian Defence Force, national parks, pension payments, health care and infrastructure.

Budget documents are prepared by the Departments of the Treasury and Finance and are presented to parliament by the Treasurer. Budget night is normally in May, to enable parliament to consider the Budget before the new financial year begins. However, presentation of the Budget may occur at another time (e.g. if a general election would prevent delivery of the Budget in May).

Appropriation Bills reflect decisions made by the Cabinet and/or the Prime Minister, through the Budget process. Budget decisions are agreed by the Cabinet before appropriation Bills are introduced in parliament.

Members of parliament examine and debate the Budget Bills in the same way as any other Bills. The Senate also scrutinises the Budget in estimates committees.

Bills proposing annual appropriation Acts

In parliament, a Bill is a proposal for an Act or a change to an existing Act. An appropriation Bill, or supply Bill, is a proposed law/Act for appropriations from the CRF, for expenditure of Commonwealth funds by entities.

Appropriation Bills are introduced with explanatory material that includes Explanatory Memoranda. These explain the Bills and the changes from previous appropriation Acts and are also supported by Portfolio Budget Statements (PB Statements). Information on PB Statements is included below.

The 3 main annual appropriation Bills, introduced to parliament on Budget night, are:

- Appropriation Bill (No. 1) - a key element in the Budget that contains details of estimates for ordinary annual services of the government (i.e. for the continuing expenditure by Commonwealth entities on services for existing policies)

- Appropriation Bill (No. 2) - for new administered expenses, non-operating costs, and payments to states, territories and local government

- Appropriation (Parliamentary Departments) Bill (No. 1) - proposes appropriations for the parliamentary departments.

All three appropriation Bills include, for information purposes, a figure for the previous financial year, labelled the ‘Actual Available Appropriation’. This is calculated for each item by adding the amounts appropriated in the previous year’s annual appropriation Acts, adjusted under provisions of the PGPA Act, and other adjustments, such as by an Advance to the Finance Minister (AFM).

In some instances, the figures in the appropriation Bills may also be affected by administrative limits applied by Finance (e.g. withholding applied to reflect movements of funds or other savings decisions). The actual available appropriation provides for comparison with the proposed appropriation. It does not affect the amounts made available at law.

There is no special Budget procedure as such. The Budget depends upon the passage of the main appropriation Bills for the year, which essentially follow the same stages as any other Bills. When appropriation Bills are passed by parliament and receive Royal Assent by the Governor-General, they become appropriation Acts—the laws that authorise money to be drawn from the CRF.

If the main appropriation Bills are not passed before the commencement of the financial year, parliament may pass supply Bills. Supply Bills are appropriation Bills that propose appropriations for interim funding, usually used in situations where the main Budget Bills are unlikely to pass in time for the new financial year (e.g. if an election would interrupt the normal Budget cycle).

Portfolio Budget Statements

The PB Statements inform parliament and the public of the proposed allocation of resources to government outcomes, and assist the Senate Estimates Committees with their examination of the Budget. The PB Statements are prepared by:

- Commonwealth entities who receive funding through the annual appropriation Acts (either directly or through a portfolio department), or

- where Finance requires a non-Budget appropriated entity to produce a chapter, when there is greater scrutiny on its operations or Budget and forward estimates (e.g. the Future Fund Management Agency).

Under subsection 15AB(2)(g) of the Acts Interpretation Act 1901 (Acts Interpretation Act), the PB Statements are considered extrinsic material for the interpretation of appropriation Bills/Acts. Annual appropriation Bills, tabled in parliament on Budget night, require the PB Statements to be taken into account for interpreting the appropriated items.

A court may use the PB Statements to determine whether particular expenditure is consistent with the purpose of an appropriation item.

The PB Statements contain details of estimated payments under each annual appropriation Bill and estimated payments under appropriations by other legislation. The PB Statements also contain estimated receipts from other sources, including taxation, customs, excise and receipts from fees and charges collected by entities. Appropriation details in the PB Statements match the figures in appropriation Bills and relevant amounts included in Budget Paper No. 4.

Individual PB Statements further explain the purposes and planned performance of entities.

Entities are required to include in the PB Statements, details for program objectives and planned financial and non-financial performance (i.e. deliverables and key performance indicators) as detailed in Finance Secretary Direction under subsection 36(3) of the PGPA Act.

PB Statements tables, data and footnotes are made available after the Budget is released to assist those who wish to analyse the financial information published in the PB Statements.

Each year, Finance issues guidance to preparing the PB Statements, which includes the requirements for content, format and printing. CBMS manages the flow of financial information between Finance and entities, to facilitate cash and appropriation management, the preparation of Budget documentation and financial reporting. The CBMS training site also includes fact sheets, training and forms.

Additional Estimates

Some entities will need more funds for the financial year than those originally appropriated by the Budget appropriation Acts. These amounts may be appropriated through the Additional Estimates (AEs) appropriation Bills.

Additional annual appropriation Bills are usually introduced during the financial year, during the Additional Estimates process. These additional appropriation Bills seek authority from parliament to access money from the CRF in order to meet the additional financial requirements that have arisen since the Budget, and were not covered by the first set of annual appropriation Acts.

The AEs appropriation Bills propose appropriations in:

- Appropriation Bill (No. 3) - proposes appropriations for ordinary annual services of the government in addition to appropriations provided by Appropriation Act (No. 1)

- Appropriation Bill (No. 4) - proposes appropriations for certain expenditure, in addition to appropriations provided by Appropriation Act (No. 2)

- Appropriation (Parliamentary Departments) Bill (No. 2) - proposes appropriations for expenditure by the parliamentary departments, in addition to the appropriations provided by Appropriation (Parliamentary Departments) Act (No. 1).

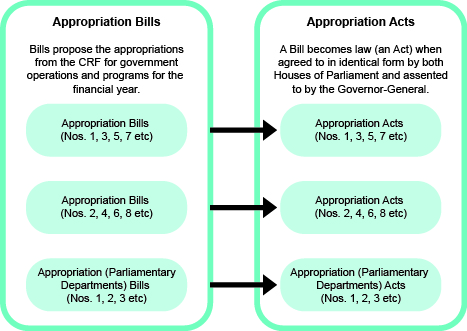

The following diagram shows the progression of annual appropriation Bills and Acts and the numeric sequencing that applies.

Figure 1: Progression of annual Appropriation Bills and Acts within a financial year

Portfolio Additional Estimates Statements

The purpose of the Portfolio Additional Estimates Statements (PAES) is to inform senators and members of parliament and the public of the proposed additional allocation of resources to government outcomes by entities within the relevant portfolio.

While the PAES include an Entity Resource Statement to inform parliament of the revised estimate of the total resources available to an entity, the focus of the PAES is on explaining the changes in resourcing since the Budget. As such, the PAES provide information on new measures and their impact on the financial and non-financial planned performance of entities.

The PAES are declared by the Additional Estimates appropriation Bills to be a 'relevant document' to the interpretation of the Bills according to section 15AB(2)(g) of the Acts Interpretation Act. The PAES update the most recent budget appropriations for entities within the relevant portfolio.

The PAES are usually tabled in parliament in mid-February each year and only those entities for whom the government has agreed appropriation changes need to produce the PAES.

Entity obligations

It is important that entities rigorously manage the preparation of estimates for inclusion in appropriation Bills, to support:

- Cabinet decision-making for appropriations in the Budget

- the reliability and accuracy of information published in the Budget papers, including the PB Statements and the PAES.

This is particularly important for programs funded through special appropriations, many of which are demand driven. Related estimates for these are prepared using entity funding models. Such models may include price and volume variables, and certain behavioural and elasticity variables. Good management of the estimates for such programs requires ongoing dialogue between the managing entity and Finance.

The estimates for most special accounts (a subset of special appropriations) largely represent non-Budget funded amounts. Entities should regularly update the estimates for special accounts and variations in consultation with the relevant Finance Agency Advice Unit (AAU).

Part 3 – Annual appropriation Acts

Parliament has ultimate control over public finances—legislation is required for both taxes to be imposed and for government expenditure. Under section 83 of the Constitution, no money can be drawn from the CRF except under an appropriation made by law (e.g. an appropriation Act).

Annual appropriation Acts provide funding from the CRF for entities to undertake the services of the government. The cycle and process of appropriation Bills for the passing of annual appropriation Acts, provides parliament with a regular opportunity to scrutinise the government’s new and ongoing spending activities.

As detailed in Odgers' Australian Senate Practice, Chapter 13 - Financial legislation, interpretation of the ‘ordinary annual services of the government’ was substantially settled in 1965 by what amounted to an agreement between the Senate and the government, generally referred to as the Senate-Executive Compact (the Compact), and by agreed application of the terms of that agreement since that time. The interpretation has since been revisited on a number of occasions (e.g. in 1999 to take account of accrual budgeting). The government continues its consultations with the Senate in reviewing the terms of the Compact for defining the ordinary annual services of the government.

As a result, appropriations for the services of the government are split into:

- Appropriation Act (No. 1) - appropriates money for the ordinary annual services of the government, and

- Appropriation Act (No. 2) - appropriates money for services other than ordinary annual services of the government, such as new administered outcomes, non‑operating costs, and payments to states, territories and local government.

By convention, appropriations for parliamentary departments are contained in a third annual appropriation Act:

- Appropriation (Parliamentary Departments) Act (No. 1) - appropriates money for expenditure in relation to parliamentary departments, and related purposes.

Appropriation Act (No. 1)

Appropriation Act (No. 1) appropriates money for the ordinary annual services of the government, and for related purposes, including:

- departmental operating costs

- minor departmental capital costs

- administered outcomes that have been previously authorised by parliament.

Appropriation Act (No. 1) also sets appropriations according to whether they are:

- departmental appropriations (i.e. money for the annual operating costs of entities, over which an entity has control), such as:

- employee expenses

- supplier expenses

- other operational expenses (e.g. interest and finance expenses)

- non-operating costs (e.g. replacement and capitalised maintenance of existing departmental assets); or

- administered appropriations (i.e. money for carrying out Commonwealth objectives, with amounts for each outcomes). Administered appropriations are amounts required to meet the total estimated expenses in the Budget year for activities administered by the entity on behalf of the Commonwealth.

Schedule 1 of Appropriation Act (No. 1) details the services for which money is appropriated. Departmental appropriations are shown as a single amount for each entity, representing the cost of entity operations. While a split of that appropriation across outcomes is shown, the split is notional, providing an indication of the estimated departmental resources required to achieve the entities’ outcomes. An appropriation is not provided for non-cash costs such as bad debts and write-offs.

Departmental appropriations can also include supplementation for work that entities are directed by the government to undertake in the previous financial year, but after the last date for inclusion in additional estimates appropriation Bills. Entities are expected to meet the cost of such activities from their existing appropriations, which may then be replenished by a departmental appropriation in the following financial year.

For all non-corporate Commonwealth entities (NCEs), departmental non-operating costs are funded via the departmental capital budget, to meet the costs associated with the replacement of minor assets (i.e. assets valued at $10 million or less), or maintenance costs that are eligible to be capitalised (e.g. depreciation, amortisation and make-good expenses).

Corporate Commonwealth entities (CCEs) continue to be funded for depreciation, amortisation and make-good expenses except for designated collecting institutions (e.g. the National Gallery of Australia, which is not appropriated for the depreciation of heritage and cultural assets).

Appropriation Act (No. 2)

Appropriation Act (No. 2) appropriates amounts that are not for the ordinary annual services of the government. Amounts are set for particular purposes:

- ‘non-operating’ costs (sometimes called ‘capital’ costs) which include:

- equity injections for specific purposes, such as to enable investment in assets to facilitate departmental activities, or for new assets and replacement assets usually valued at more than $10 million

- administered assets and liabilities, which provides funding for acquiring new administered assets, enhancing existing administered assets and discharging administered liabilities relating to activities administered by entities on behalf of the Commonwealth

- payments to corporate entities (CCEs and Commonwealth companies)

- ‘new administered outcomes’

- some payments to states, territories and local governments.

Schedule 1 of Appropriation Act (No. 2) details payments to or for the states, territories and local governments. It also confers powers on ministers, to determine the conditions under which payments to and through states, territories and local government authorities may be made and the amounts and timing of payments.

Schedule 2 of Appropriation Act (No. 2) sets appropriations for services to be delivered.

Most appropriations for payments to and through states and territories are made under the Federal Financial Relations Act 2009, and the related COAG Reform Fund Act 2008. Ongoing payments classified as ‘through’ the states for non-government schools that are made under the Schools Assistance Act 2008. Financial assistance grants for local government are made under the Local Government (Financial Assistance) Act 1995.

Appropriation (Parliamentary Departments) Act (No. 1)

Appropriation (Parliamentary Departments) Act (No. 1) appropriates money for expenditure in relation to parliamentary departments, including for the departmental, administered and non‑operating costs of these departments.

Period of validity

Unspent annual appropriations do not lapse at the end of each financial year. Annual appropriations continue to be available to entities until:

- the relevant amount is fully expended, or

- the relevant appropriation Act is repealed.

Since 2015, annual appropriation Acts are automatically repealed (i.e. cease to have effect) three years after they are passed by parliament. Once repealed, any unspent appropriations are no longer available to the entity to spend.

Mechanisms for seeking an increase to annual appropriations

There may be situations where entities require extra funding for urgent expenditure for which there is insufficient appropriation.

Appropriation Acts (No. 1) and (No. 2) contain an Advance to the Finance Minister (AFM) clause, which enables the Finance Minister to provide urgent additional appropriation. Appropriation (Parliamentary Departments) Act (No. 1) contains a corresponding clause for an Advance to the responsible Presiding Officer (APO).

Before considering the use of the AFM or APO, existing appropriations must first be considered. This includes investigating whether it would be possible and appropriate to:

- rely on an existing administered appropriation, within the same outcome

- reverse an administrative quarantine that has been placed against a suitable appropriation

- release an amount withheld from a suitable appropriation, under section 51 of the PGPA Act (policy authority from Cabinet or Prime Minister may be required)

- rely on an existing departmental appropriation

- re-prioritise current spending until the passage of the next set of appropriation Bills

- request to reallocate appropriations between activities that are funded by appropriation Act items, in accordance with the Budget Process Operational Rules (BPORs).

Further information on AFM and APO provisions is included at Part 7.

Using departmental appropriations for administered purposes

As mentioned above, the annual appropriation Acts provide funding for two types of expenditure (referred to as “items” in the appropriation Acts): administered and departmental.

Departmental items cover expenditures over which a NCE has control. Departmental appropriations in an odd-numbered appropriation Act can be used to make payments related to departmental purposes including administered items in an odd-numbered appropriation Act whether or not there are amounts shown in the Act for the entity. Departmental items are not tied to outcomes and any allocation in the appropriation Acts is notional only. The appropriateness of using departmental items in an odd‑numbered appropriation Act to fund expenditure under an even-numbered appropriation Act needs to be assessed on a case-by-case basis and may require seeking legal advice from the Australian Government Solicitor. This is because the items in an even‑numbered appropriation Act are regarded as being outside the ordinary services of government, for example, payments to states and territories.

Administered items are those administered by a NCE on behalf of the Government. Administered items are tied to outcomes (departmental items are not).

Outcomes for administered and departmental items are the same.

Using departmental appropriations to make payments for administered activities/purposes might be necessary where the Government takes a decision to commence or continue an administered activity for which no appropriation has been provided in the current annual appropriation Acts, the entity does not have prior year appropriations for the relevant outcome and there is insufficient time or other reasons why the AFM is not appropriate.

Below are some frequently asked questions on the use of departmental appropriations for administered purposes:

Does using departmental appropriations for administered activities change the appropriation type?

No. The appropriation type is defined by the appropriation Act and does not change regardless of the purposes of the expenditure.

What approval is needed to report an operating loss where a NCE used departmental appropriations for administered purposes?

The use of prior year departmental appropriations to make payments for administered purposes may result in the entity reporting a departmental operating loss. Approval of departmental operating losses is governed by the BPORs. Operating losses resulting from the use of prior year departmental appropriations for administered payments would normally be considered technical losses, and can be approved by Finance. Should an entity consider that an operating loss is likely for any reason, they should contact the relevant Finance AAU in the first instance.

How should the expenses be accounted for?

The use of departmental appropriations should be recorded as departmental expenditure while the use of administered appropriations should be recorded as administered expenditure. Entities should record administered and departmental expenses, assets and liabilities in accordance with Australian Accounting Standards.

Guidance on how NCEs should account for administered and departmental expenses is provided in Part 2.3 - Reporting of departmental and administered items of Part 2.3 - Reporting of departmental and administered items of RMG-125 Commonwealth Entities Financial Statements Guide. Additional guidance on accounting for annual appropriations is also available in RMG-116 Accounting for annual appropriations.

Does paying the departmental appropriation into an administered bank account have any effect on the appropriation type?

No. As above, the appropriation type is identified in the relevant appropriation Act. Whilst it may be administratively easier for the entity to mingle departmental and administered appropriations in a single bank account, there is no change to the nature of the appropriation and the way the appropriation should be reported. Entities are reminded of their obligations under the PGPA Act to ensure accurate and complete records are kept. Mingling different appropriation types may make this more difficult, but this is a matter for the entity to determine.

Part 4 – Special appropriations

A special appropriation is a provision contained within an Act, other than an annual appropriation Act, whereby parliament authorises the Executive Government to expend money from the CRF for specified purposes (e.g. the Social Security (Administration) Act 1999 contains several special appropriations to make social security payments).

Like annual appropriation Acts, the Act that creates a special appropriation provides the authority for drawing money from the CRF, as well as the purposes for expenditure. Expenditure must be consistent with the provisions of the Act, the PGPA Act and government policy. To draw money from the CRF beyond the scope of the appropriation constitutes a breach of section 83 of the Constitution.

While the Finance Minister is responsible, on behalf of the government, for the reporting and financial management arrangements and requirements to which entities must adhere, entities are responsible for:

- understanding and appropriately applying the legal provisions of each appropriation that they manage

- using an appropriation in accordance with the purpose and conditions of that appropriation

- maintaining records of and reporting on appropriations.

Government activities and programs that are funded using special appropriations usually involve expenditure over a long period of time or on an ongoing basis, which can result in large cumulative costs. Therefore, special appropriations are often not specific in amount or duration and the authority to withdraw funds from the CRF does not generally cease at the end of the financial year.

Special appropriations, sometimes called ‘standing appropriations’, can provide for appropriations for ongoing payment arrangements, for circumstances specified in legislation (e.g. the Aged Care Act 1997 provides for continuing expenditure on various subsidies for the provision of aged care services). Parliament does not have the opportunity to revise the terms of a special appropriation after the legislation has been passed, except by legislative amendment.

Some special appropriations state a maximum amount that is appropriated for the particular purpose—these may be referred to as ‘limited by amount’.

Other special appropriations may be ‘unlimited’—these do not state a maximum amount but specify that payments are to be calculated according to legislative criteria.

The Administrative Arrangements Order (AAO) sets out the legislation that is administered by ministers of state (portfolio ministers). Entities are responsible for ensuring that all the special appropriations in the legislation assigned to their minister are properly managed by the entity, or are allocated by the minister to another entity in the minister’s portfolio. However, entities may spend money from special appropriations for and on behalf of another portfolio minister where appropriate legal measures are in place (e.g. formal delegations).

The Chart of Special Appropriations lists all special appropriations (not including special accounts or appropriations that increase the balance of special accounts), that are managed by NCEs. The Chart is intended to assist officials in the effective management and reporting of special appropriations. It is updated whenever a new special appropriation is created, an old one is abolished, or when the entity administering a special appropriation changes.

Considerations for proposing a special appropriation

Whether a government activity should be funded via an annual or special appropriation is most often informed by the proposed implementation and delivery method when developing a particular policy proposal. Where possible, entities should endeavour to design activities and programs so that funding requirements can be managed with an annual appropriation—this enables the government to consider expenditure priorities as part of the annual Budget cycle.

A special appropriation may be established when an annual appropriation is unsuitable to deliver a particular government activity. It is not possible to provide a definitive list of when a special appropriation, or special account, is appropriate as most activities involve unique policy considerations and tailored implementation processes.

The requirement for a special appropriation must be considered on a case-by-case basis with various factors taken into account (e.g. a cash limited appropriation may be inappropriate for a program that is entitlement-based or demand driven). Before proposing the establishment of a new special appropriation, entities need to balance considerations of the fiscal impact, policy authority, stakeholder expectations and implementation models.

Before developing legislation for a special appropriation, the policy proposal must be considered by the Cabinet and/or Prime Minister, through the Budget process. Once the policy proposal is agreed by the Cabinet and/or Prime Minister, then a Bill containing the special appropriation can be drafted.

Bills containing special appropriations are normally sponsored and introduced into parliament by the relevant minister with the policy responsibility for the activities of the specific Act.

The use of a special appropriation is a matter for careful policy consideration. Special appropriations should only to be proposed when it is necessary, or desirable to (the following list is not exhaustive):

- create a legal entitlement to a benefit, to provide that benefit to everyone who satisfies the criteria set out in the legislation, noting that the special appropriation might be uncapped (e.g. the age pension)

- give effect to inter-governmental or industry arrangements by providing a specific amount to certain persons or bodies under stated conditions (e.g. the Schools Assistance Act 2008 and the Local Government (Financial Assistance) Act 1995)

- support the independence of an office from the parliament and the executive, by providing for the automatic payment of remuneration to holders of the office (e.g. the salaries of judges, statutory office holders and the Auditor-General)

- demonstrate Australia’s ability to meet its financial obligations independently of further parliamentary approval of funds (e.g. the repayment of loans to multilateral international organisations)

- transfer the balance of a special account being ceased to a receiving body (e.g. to a CCE, Commonwealth company or body outside the Commonwealth)

- implement transitional arrangements, in particular, as part of the restructuring of bodies within and/or outside of the Commonwealth.

Considerations for proposing a special appropriation include:

- the timing of an activity - if the activity is unlikely to be ongoing or the funding is not material, using a special appropriation may be difficult to justify

- unique circumstances - if the program would be very difficult to accommodate within annual appropriation Acts, a special appropriation may be justifiable

- additional transparency - if it is desirable for the authority to undertake certain functions and the appropriation for those functions is to be included within the same Act, a special appropriation may be appropriate.

It is important to note that satisfying one or more of these conditions does not necessarily mean that a special appropriation should be established. Where a special appropriation is proposed for other circumstances, this should be discussed with the relevant Finance AAU as part of the policy development and costings process.

As a general principle, any legislation authorising expenditure programs will require that decision-makers administer the program within the funds approved in the Budget, and provide an appropriate means by which available funds can be rationed if necessary (e.g. by adjustments to eligibility criteria, the levels of grant, or deferment of payment).

Consideration also needs to be given to establishing a financial limit or sunsetting arrangement in the legislation, so that a special appropriation is not continued beyond the initial requirements, without further government and parliamentary approval.

Establishing special appropriations

All proposed provisions which are in any way related to a special appropriation (including special accounts), for the use or control of Commonwealth moneys, must be determined in consultation with Finance. The Finance Minister must be consulted on all Bills proposing a special appropriation and the measures contained in a Bill must have policy approval at the appropriate level. The Treasury must be consulted on proposals that affect taxation law.

Entities are to consult their Finance AAU early in the design process for a program that may establish or amend a special appropriation, before making a proposal for a special appropriation.

Constitutional advice from the AGS could indicate whether a special appropriation is suitable for moderate to higher risk policy proposals. Such proposals may require consideration by Cabinet and usually need to be supported by primary legislation.

Information on policy approval and legislation processes is provided in the Cabinet Handbook and the Legislation Handbook.

Reviewing and abolishing special appropriations

Entities need to periodically review the need to retain individual special appropriations. Where a special appropriation is no longer used, or can be replaced by an annual appropriation, entities are encouraged to consider repealing that special appropriation (e.g. if no expenditure is reported for a special appropriation in a financial year, then the entity should review the ongoing need for that appropriation).

Where the need to continue a special appropriation is questionable, entities should liaise with their Finance AAU or the Special Appropriations Team.

Commonwealth repayments where no appropriation is available

Section 77 of the PGPA Act provides that an NCE can use a special appropriation contained in the PGPA Act in certain circumstances to repay money that is collected and processed as general government revenue (i.e. the amount remitted to the OPA as an administered receipt).

Examples of repayments that may be made under section 77 of the PGPA Act include:

- returning a bond, a security deposit or an amount found on Commonwealth premises

- returning an overpayment to the Commonwealth

- repaying an amount to a related third party (e.g. to the executor of a deceased estate)

- repaying an amount that was credited to a departmental item or a special account where there is no available balance in the respective appropriation to make the required repayment.

The special appropriation provision in section 77 of the PGPA Act may only be used to make a repayment if the entity has no other appropriation for that repayment. For example, if an entity receives an overpayment and credits it to an annual departmental appropriation:

- under section 27 of the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule), the entity must make the repayment from that departmental appropriation, however

- if the entity were instead to remit the overpayment to the OPA as an administered receipt, then the entity may use the provisions included in section 77 to make the repayment.

Provisions in section 77 of the PGPA Act do not extend to CCEs or Commonwealth companies.

Budget Paper No. 4 - Special Appropriations Table

Budget Paper No. 4, produced as part of the annual Budget process, sets out the funding for entities, their funding sources and purposes. Budget Paper No. 4 includes a special appropriations table that lists the Acts that contain one or more special appropriation.

Acts are listed under the relevant entity, consistent with the most recent AAO. All amounts in Budget Paper No. 4 are shown under the entity whose minister/s has responsibility for the special appropriation legislation concerned. The Agency Resourcing table presents total special appropriations for each entity, by outcome and for each portfolio. The table is presented in two parts:

- the first is a summary table showing the total special appropriations by portfolio

- the second shows the estimate for each Act containing a special appropriation for each entity for the Budget year and an ‘Estimated Actual’ figure for the previous year.

The amounts in these tables are used to set initial cash management budgets in CBMS at the start of each financial year.

Part 5 – Special accounts

A special account is a type of special appropriation, established under sections 78 and 80 of the PGPA Act. A special account is a type of limited special appropriation, which notionally sets an amount of money aside in the CRF, for expenditure on defined purposes.

A special account can be established either by:

- by an Act, under section 80 of the PGPA Act

- a determination by the Finance Minister, under section 78 of the PGPA Act (such determinations are legislative instruments).

All proposed special accounts, whether they are initiated through an Act or a determination, are considered by parliament before becoming law. The Act or determination that establishes a special account specifies the purposes for which the special account may be debited. Sections 78 and 80 of the PGPA Act, as relevant, provide the authority for money to be drawn from the CRF (rather than the authority provided by the relevant legislation or determination).

A special account establishes a ledger in law, enabling segregation of funds and separate accounting to support an identified activity, including within an entity. Special accounts are treated the same as other types of appropriation (annual and special) and form part of an entity’s annual financial statements. They do not exempt the entity from BPOR requirements, particularly the rules relating to operating losses and new policy proposals.

The amount of appropriation that may be drawn from the CRF is limited to the balance of each special account at any given time. The appropriation balance of a special account is a legal concept that indicates the limit of the available appropriation—it is not a bank account balance.

Special accounts may be established when it is clear that other types of appropriations are not suitable (e.g. there may be a need for specific transparency, including where activities are jointly funded with other governments). The establishing determination, and in most cases the establishing Act, identifies the types of receipts that may be credited to increase the balance of the special account.

Any expenditure made using a special account can only be for the legislated purposes of that special account. However, no policy or law for special accounts compels the entity to use the special account to implement an initiative.

Legislated provisions for special accounts on their own do not authorise an NCE to:

- manage non-Commonwealth money—consistent with the Constitution, all money held by the Commonwealth forms part of the CRF, to be used for Commonwealth expenditure

- establish an entity—a special account does not provide legal or financial independence from the managing NCE

- transfer accountability for spending—special accounts used for expenditure on statutory office holders, advisory boards and advisory committees must be managed by the accountable authority. The expenditure is consolidated in the managing NCE’s financial statements

- operate a departmental loss—an operating loss occurs if an NCE’s departmental expenses are more than departmental revenue in the same financial year. As special accounts allow a balance to increase over years, special accounts used for departmental expenditure increase the risk of a departmental operating loss. Government approval is required to report an operating loss. For more guidance, consult the relevant Finance AAU or the BPORs

- spend more than agreed estimates—government approval is required to spend more than agreed estimated expenditure, even if a revised amount would remain within the balance of a special account or remain within an agreed estimated envelope across years. In the BPORs, the latter is termed a ‘movement of funds’ across financial years. Spending more than agreed estimates would increase government expenditure

- recover costs by charging—recovering costs by charging for goods and services requires a policy decision, generally a Cabinet decision. A policy to charge is to be legislated in an Act. Charging must be consistent with the Australian Government Charging Framework (RMG 302), or

- raise revenue—raising revenue by investing money requires authorisation in an Act or a written delegation from the Finance Minister under authority in the PGPA Act. The legislation establishing a special account does not provide authority to invest the balance of that special account.

Some special accounts sunset after a set period of time. At the time a special account ceases, any unspent balance is no longer available to the entity to spend.

There can be no ‘negative’ special account balances.

Entities that can manage a special account

As special accounts appropriate funds from the CRF, for use by the Commonwealth, they can only be managed by an NCE, or by a CCE for and on behalf of an NCE. This is because CCEs are legally separate from the Commonwealth. Where the purposes of a special account include making payments to a CCE, that CCE cannot manage the special account for and on behalf of the responsible NCE.

Where a CCE manages a special account for and on behalf of an NCE, the accountable authority for the NCE remains responsible for the special account.

The Chart of Special Accounts lists all special accounts managed by portfolio departments. The Chart is updated whenever a new special account is created or abolished, and when the administration of a special account changes.

How special accounts work

Special accounts are a subset of special appropriations where, the amount that may be drawn from the CRF is limited to the balance of the special account at any given time. Legislative and policy authority is required to spend from the special account balance:

- legislative spending authority—provided in the establishing legislation for the special account, and also in the PGPA Act, limiting spending to the special account balance

- policy authority—limits spending within the special account balance by up to the expenditure estimate agreed by the Executive Government as part of the Budget process.

Amounts forming part of the appropriation balance of a special account may be held in various ways, as:

- cash in the OPA, available to be drawn down when a payment is made

- cash in a NCE's bank account, or

- a combination of the above.

However, generally, the entire balance of a special account is not held as cash. Cash is usually only held for amounts required to make foreseeable payments. If special account-related amounts are held in a bank account, and are not required for immediate spending, they should be remitted back to the OPA. These amounts remain available for withdrawal when required.

Entities may choose to set up a separate bank account for special account-related transactions, or use an existing departmental or administered bank account to handle special account-related moneys.

Special account transactions

References to special account credits and debits refer to increases or decreases of the appropriation balance and not deposits to and withdrawals from a bank account.

The determination (i.e. legislative instrument) or Act that establishes a special account will specify the purposes for which the special account may be debited. The determination, and in most cases the Act, will also identify the types of receipts that may be credited to increase the special account balance.

The kinds of money raised that may be set aside with a special account will usually be specified in the Act (where an Act establishes the special account), and will always be specified in a legislative instrument that establishes the special account. Sometimes these specifications are referred to as ‘crediting clauses’ or ‘crediting provisions’.

Any amounts recorded as a credit (increase) to the balance of a special account must be consistent with the crediting clauses of the special account. Depending on its purpose, a special account may be credited with amounts from:

- annual appropriations (an annual appropriation Act may provide for amounts to be credited to a special account, if any of the purposes of the account are also a purpose covered by an item within the annual appropriation Act)

- special appropriations

- third parties

- direct legislative provisions (sometimes referred to as ‘statutory credit’)

- investment income (in limited circumstances).

If an amount appropriated as an annual administered item is to be credited to a special account, then this must occur during the financial year in which the amount was appropriated.

Debiting a special account to make a payment will decrease the appropriation balance. The kinds of payments permitted from a special account are specified within the Act or instrument that established the special account. Sometimes these specifications are referred to as ‘debiting clauses’ or ‘expenditure purposes’.

Debiting a special account for payments that are inconsistent with the legislated debiting purposes would breach section 83 of the Constitution.

Under section 36 of the PGPA Act, the balance of a special account must be accurately recorded in the NCE’s internal accounts and records, and in CBMS.

As required by subsection 78(7) and subsection 80(4) of the PGPA Act, the available appropriation of a special account increases or decreases from the time a transaction is recorded in the accountable NCE’s internal accounts and records. Therefore, the date and time a transaction is recorded, could result in the NCE’s accounts and records being ahead of CBMS data and entities should ensure CBMS is updated regularly.

A negative special account balance may indicate that an administrative error has occurred, or that the entity has spent more than the appropriation limit. Entity accounts and records that show a negative special account balance must be checked for accuracy.

If a special account was credited or debited in error (i.e. inconsistent with the spending purposes), the transaction can be reversed in records, so that the balance is not changed in error. The NCE should hold relevant supporting documentation and discuss such cases with its internal auditors.

Investing money from a special account

It is not standard practice for NCEs to raise revenue by investing money or earning interest on money held in bank accounts. While a special account provides an appropriation, the legislation that establishes a special account does not authorise investing money or earning bank account interest.

Enabling legislation (e.g. the Future Fund Act 2006 for the Future Fund Board of Guardians and the Future Fund Management Agency) may authorise ministers or entities to invest.

Section 58 of the PGPA Act also authorises the Finance Minister to invest relevant money in authorised investments and to delegate this authority. Those NCEs that are required to invest or earn revenue are authorised to do so by written delegation of the Finance Minister.

To invest money from a special account, or to authorise reinvestment upon maturity of the proceeds of an authorised investment, the portfolio minister for the NCE is required to seek written delegation by the Finance Minister under section 58 of the PGPA Act. Delegates must ensure that the investment of relevant money is consistent with the requirements of section 58, including being limited to the authorised investments as described in subsection 58(8).

Section 53 of the PGPA Act authorises the Finance Minister to open and maintain bank accounts on behalf of the Commonwealth, and to delegate this authority with accompanying directions, that include requiring interest on bank accounts to be earned by the Commonwealth centrally. The directions may be amended if required.

To open and maintain a separate bank account to allow the appropriation balance of a special account to be invested and earn interest, the portfolio minister for the NCE is required to obtain written delegation by the Finance Minister under section 53 of the PGPA Act.

Where a special account is established, rather than providing ‘investing or banking’ authorisation, the government has, in some cases, approved supplementary annual funding to credit to the special account. Supplementary annual funding, provided in annual appropriation Acts, is called an ‘Interest Equivalency Payment’. The possible receipt of supplementary appropriation is not a reason to establish a special account.

Trusts and special accounts

Unless it is expressly in the Commonwealth’s interest to do so, entities are discouraged from:

- establishing a trust (under a trust deed or a trust instrument), where the Commonwealth would be a beneficiary or act as a trustee

- accepting trust-like responsibilities where the Commonwealth would be acting as a trustee.

It is important to understand the legal, financial and other implications for the Commonwealth before entering into a trust or trust-like arrangement. If an NCE holds money on trust for a person outside of the Commonwealth (such as an individual, company or non-government organisation), that money may form part of the CRF. If such money is considered part of the CRF, an appropriation is required to spend that money, including repaying a trust benefactor. Before entering into such an arrangement, NCEs should:

- consult the relevant Finance AAU and PGPA and Digital Reporting Branch

- obtain policy authority (a decision of Cabinet or the Prime Minister)

- obtain legal advice from their internal legal area or the AGS.

A special account is not necessary to manage money held on trust (e.g. money held on trust to undertake departmental activities, can be managed using departmental appropriations and the provisions in section 74 of the PGPA Act and section 27 of the PGPA Rule). More information is provided at Part 8.

Legal trusts are generally established under state and territory laws and usually require money to be held ‘separately’. Such separation can be achieved by an NCE maintaining a separate bank account to manage money held on trust as part of its annual departmental appropriation. Additional transparency can be provided in the NCE’s annual report by adding a note to the financial statements under the heading ‘Assets on Trust’.

Considerations for proposing a special account

An annual appropriation is the default funding method for proposed expenditure agreed by the Executive Government. If an annual appropriation is unsuitable to implement the policy, then the portfolio minister can consult the Finance Minister on alternative appropriation methods. Draft ministerial correspondence to the Finance Minister can be sent to the Finance Special Appropriations Team for review of technical accuracy.

Special accounts may be established when it is clear that other appropriation types are unsuitable. For example, a special account may be established as part of creating a fund or a foundation to implement initiatives that involve money being set aside and, in some cases, money being raised by investing (e.g. the Future Fund Act 2006 established the Future Fund, which consists of the Future Fund Special Account and investments of the Fund).

Special accounts are treated the same as other types of appropriations (annual and special), and form part of an entity’s financial statements. They do not exempt an entity from BPOR requirements, particularly those relating to operating losses and new policy proposals.

Advantages of a special account in one instance may be a disadvantage in another.

Table 1: Examples of special account advantages and disadvantages

Advantages: | Disadvantages: |

|---|---|

|

|

In assessing whether a new special account may be appropriate, an NCE is encouraged to consider the following questions, for consultation with the Finance Special Appropriations Team:

Table 2: Key questions for consideration of a special account

| Key questions: |

|---|

|

The Finance Minister considers all proposals for special accounts on a case-by-case basis and, while a proposal may fulfil all the criteria, agreement to establish a special account is at the Finance Minister’s discretion.

For further guidance on establishing a special account, contact the Finance Special Appropriations Team.

Establishing a special account

Consistent with the PGPA Act, special accounts can be established, with the written agreement of the Finance Minister by a determination, tabled in parliament as a disallowable legislative instrument under section 78 of the PGPA Act, or as a Bill introduced in parliament by any minister (section 80).

Consistent with the Legislation Handbook, the relevant portfolio minister must seek written agreement from the Finance Minister to establish, vary or revoke a special account. Finance officials cannot provide ‘officer level’ support for a policy proposal that seeks government agreement to establish a special account (i.e. government agreement to expenditure on an initiative is required first).

When a Commonwealth function requires a special account, and that function is to be authorised by an Act, then the Office of Parliamentary Counsel (OPC) generally advises that the special account should be established in that same Act.

In preparing instructions for drafting special account provisions in a Bill, the NCE must liaise with the Finance Special Appropriations Team before drafting instructions are finalised. If a Bill contains a special appropriation or a special account, it is standard practice of the OPC to seek Finance comments before the Bill is finalised.

To allow sufficient time to review such Bills, the Finance Special Appropriations Team requires advice from the instructing NCE on the policy authority (Cabinet decision or letter from the Prime Minister). For each appropriation drafted in a Bill, include copies of the associated policy proposal.

The legislative process to establish a special account can be lengthy. Relevant NCEs are to contact the Finance Special Appropriations Team at an early stage, at least two parliamentary sitting periods in advance of payments from a special account being required.

If a determination-established special account is being sought, NCEs should be aware that a determination by the Finance Minister to establish, vary or revoke a special account must be tabled for six sitting days in each House of Parliament, during which time either house may disallow the special account. If no disallowance motion is passed, on the seventh day, section 79 of the PGPA Act states that the determination takes effect and the special account commences.

Amending the crediting or debiting purposes of a special account requires both policy authority and legislative amendments. For guidance and support, NCE should liaise with the Finance Special Appropriations Team.

Sunsetting and revoking or repealing special accounts

Part 4, Chapter 3 of the Legislation Act includes provisions to ensure that legislative instruments are kept up to date and only remain in force for as long as they are needed. Section 50 provides that legislative instruments are automatically repealed after a fixed period of time (subject to some exceptions). This automatic repeal is known as ‘sunsetting’.

Special accounts last until the provisions in the Act or the legislative instrument that established the special account are repealed. Special accounts made by a legislative instrument automatically sunset after ten years. Parliament does not have the opportunity to revise the terms of the special account after it has been established, except by legislative amendment.

The sunset date for specific instruments can be identified by viewing the instrument on the Legislation Register. Entities should familiarise themselves with the sunset dates (if any) of all appropriation legislation that provides funding to their entity.

Generally, legislative instruments sunset on 1 April or 1 October, on or after the tenth anniversary of their registration. The Legislation Register includes a list of those legislative instruments that are sunsetting soon.

Section 51 of the Legislation Act provides that, by legislative instrument, the Attorney‑General may defer sunsetting in limited circumstances.

A deferral of sunsetting must be requested by the Finance Minister and is limited to either 6 or 12 months. NCEs that consider that a deferral of sunsetting may be required, must contact the Finance Special Appropriations Team as soon as practicable.

The following provides the timeline for the sunsetting of a special account and, where required, establishing a new special account for the ongoing activity:

- 18 months before—a list of instruments that are scheduled to sunset is to be tabled in parliament by the Attorney‑General. The OPC must then provide each rule‑maker with a copy of this list

- six months before—Finance, in consultation with the managing NCE, is to assess if a new special account is required for the ongoing management of the related activity

- at least two parliamentary sittings before—where both Finance and the managing NCE agree that a new special account is recommended, the portfolio minister is to write to the Finance Minister requesting a new special account for the ongoing management of the activity

- on establishment of a new special account—before the sunset date of the ceasing special account, the managing NCE must transfer the balance from the ceasing special account to the new special account, to ensure the appropriation is not extinguished.

This timeline provides sufficient time for determinations to be made by the Finance Minister and for the determination to be registered and tabled in each House of Parliament for a six sitting day disallowance period after which the determination takes effect—noting that, at times, the disallowance period may span parliamentary periods.

If a sunsetting special account is used to manage an ongoing departmental activity, it may be appropriate to transfer the special account balance to an annual departmental appropriation and no longer use the special account. To do this, the portfolio minister must provide a written submission to, and for agreement by, the Finance Minister under section 74 of the PGPA Act and section 27 of the PGPA Rule. For more information, NCEs should contact the Finance Special Appropriations Team.

Reviewing and revoking or repealing a special account before sunsetting

Entities are encouraged to revoke special accounts that have fulfilled their use or that can be replaced with annual appropriations. For example:

- if a special account is reported with a zero balance, or has no receipts and payments for two or more financial years, this signals a need to review the special account

- if the activities of a special account established by way of legislative instrument will extend beyond ten years, a review of the special account may be warranted to consider if another appropriation type may now be more appropriate.

To discuss the revocation or repeal of a special account, NCEs should contact the Finance Special Appropriations Team.

Financial estimates and reporting

In accordance with section 36 of the PGPA Act, NCEs must maintain special account expenditure estimates, transactions and balances in internal accounts and records, and also in CBMS. To ensure records are correct, CBMS should be updated as soon as practicable, to reflect the NCE’s internal accounts and records. This is important as, CBMS data is used to prepare Budget papers and the Commonwealth Consolidated Financial Statements (CFS). In accordance with section 48 of the PGPA Act, whole‑of‑government transactions are consolidated and disclosed in the CFS.

Expenditure estimates for a special account established by legislative instrument, cannot go beyond ten years. Therefore, if the related activity is ongoing beyond ten years, the forward estimates need to be recorded against another appropriation.

The estimated balances and cash flows for special accounts, for the upcoming financial year, across all Commonwealth entities, are included in the relevant entity’s PB Statements and Budget Paper No. 4. The Special Accounts Table included in this Budget Paper, lists special accounts by portfolio and managing entity. For each special account, the table shows:

- the estimated opening balance for the Budget year

- estimated cash inflows and outflows (i.e. receipts and payments) during the year

- estimated closing balance at the end of the Budget year

- estimated resources for the previous year, printed in italics

- where responsibility for managing a special account is moved between entities during the year, the part-year impact for each entity.

The final balances and cash flows for special accounts, across all Commonwealth entities, for the financial year (ending 30 June), are reported annually in the Cash Flows and Balances for Special Accounts Report.

RMG-125 Commonwealth Entities Financial Statements Guide provides guidance for disclosing special account balances and transactions in the entity’s year-end financial statements, which are included in the entity’s annual report.

Part 6 – Breaches of section 83 of the Constitution

No money may be drawn from the CRF without an Act that appropriates funding to that expenditure. Expenditure greater than the amount appropriated, or for purposes not covered by the appropriation Act, is a breach of section 83 of the Constitution. A breach could occur in payments made from either annual or special appropriations, including special accounts. While most special appropriations provide for ‘administered’ expenditure, breaches equally apply to appropriations that are ‘departmental’ in nature.

There is a higher risk of a breach occurring where the legislation prescribes preconditions for a payment being made. For example, for:

- annual appropriations—the limited level of payment specificity in annual appropriation Acts means that the risk of a breach is generally considered to be low

- however, some annual appropriations are subject to specific statutory preconditions and for these, entities are encouraged to evaluate and manage breach risks

- special appropriations (including special accounts)—the underpinning legislation, or preconditions generally provide for a higher-degree of payment specificity, therefore, there is a higher possibility of a breach occurring.

There is no materiality threshold for section 83 breaches and the occurrence of a breach does not of itself necessarily indicate serious financial mismanagement. A breach may:

- involve a small amount of money (e.g. a small payment that results in the total paid, being greater than the appropriation)

- result from a minor administrative error (e.g. where a duplicate payment is made, even if the overpayment can be recovered—noting, however, that such errors do not always create a breach. A duplicate payment from a generally-worded special appropriation, for a purpose consistent with the appropriation Act, is unlikely to breach section 83)

- involve fraudulent payments or payments made in bad faith (e.g. a payment is made on the basis of information provided by external parties, such as a welfare payment recipient, that is either incorrect, incomplete, misleading or fraudulent)

- occur where a payment is made in good faith (e.g. an entity makes payments on the basis of an administrative assessment of eligibility and/or quantum using available information given in good faith, that is later found to be incorrect or inaccurate).

In some cases, legislation may include provisions that acknowledge the need to use imperfect information to make payments. Such legislation may allow for payments based on an estimate, the recovery of overpayments through explicit recovery or adjustment mechanisms (i.e. legislation may provide for appropriations to cover excess amounts paid in error, or based on the information at a point in time). This demonstrates that parliament, in passing the legislation, explicitly recognised and allowed for a lack of certainty in payments.

Explanatory materials for legislation could also make reference to a lack of process certainty. For example, the A New Tax System (Family Assistance) Act 1999 established a scheme that allows family allowance payments to be made on the basis of the recipients estimated income. In this sense, the scheme:

- explicitly acknowledges that eligibility will be assessed on the basis of a person’s estimated future income

- recognises that any overpayments will be adjusted as part of that person’s annual income tax assessment.

Such statutory mechanisms do not completely remove the risk of a breach and entities are still encouraged to assess the associated payment processes in order to mitigate these risks.

Understanding the specific statutory requirements is important for assessing the legitimacy of a payment. An appropriation (or other statutory mechanism) may describe a payment as contingent upon certain mandatory preconditions. Where legislation prescribes preconditions, these must be strictly applied.

Where payments are made without fulfilling statutory requirements, entities may require legal advice to determine whether another appropriation would support the payments. In such instances, it may be necessary to either:

- cease making payments, if this is appropriate

- implement new payment processes that align with the legislation

- seek an amendment to the legislation to ensure alignment with required payment arrangements.

If no remedial action can be identified, the entity should urgently consult the relevant Finance AAU.

Managing the risks of a breach

To determine whether or not a particular payment, or class of payments, may be a section 83 breach, it is necessary to consider:

- the circumstances of the payment, or class of payment

- the relevant appropriation Act

- how that appropriation relates to any statutory provisions regulating entitlement to payment/s.

In accordance with section 16 of the PGPA Act and the Commonwealth Risk Management Policy, accountable authorities are responsible for their entity’s performance in managing risks.

Entities are responsible for directing resources to implement Commonwealth objectives, entity purposes and outcomes and for managing risks, including constitutional risks. Responsibility for the day-to-day risk management lies with officials at all levels.

To determine the risk of a section 83 breach occurring, entities should consider the scope of authority provided in the legislation (and potentially any additional provisions in subordinate legislation).

The possibility of a breach occurring is higher where there is a disconnect between legislated requirements and the entity’s payment processes (e.g. payments may be calculated by an official or system on the basis of assumptions or estimates, whereas the statutory provisions specify a greater-level of certainty in determining if a payment should be made and/or the payment amount).

As payment eligibility and processes vary widely between entities, it is recommended that all entities assess their own processes in light of payment circumstances, to confirm alignment with relevant statutory provisions.

Where statutory provisions involve multiple pieces of legislation, including subordinate legislation, it is possible for one entity to be responsible for a special appropriation or special account, while one or more other entities make payments from it (e.g. payments for social welfare). In such cases, all entities involved need to work collaboratively in assessing the legislative requirements and associated payment processes. Portfolio departments also need to consider any special appropriations that relate to payments made to CCEs or Commonwealth companies.

To promote a robust assessment of an entity’s payment processes and to provide adequate advice to the accountable authority, entities are encouraged to conduct a self-assessment of legislation and entity payment processes including consulting, where possible, the entity’s:

- internal legal areas or external legal providers, for assistance in interpreting the legislation and the alignment of the entity’s payment processes