Introduction

This page provides a high-level outline of the start of the grants process under the Commonwealth Grants Rules and Principles 2024 (CGRPs).

What is a grant?

A grant involves the Australian Government providing financial assistance to a grantee to achieve the government’s objectives and assist the grantee to meet their objectives.

It is important to determine whether a grant is the most appropriate funding arrangement for the proposed government spending activity. RMG-411 Grants, Procurements and other financial arrangements provides details on how to distinguish between grants, procurements and other financial arrangements. The Grants Decision Tree tool can also help you to decide if the proposed arrangement is a grant, procurement or other financial arrangement.

The CGRPs set out mandatory requirements and best practice key principles for grants administration. Not all grants are subject to the mandatory requirements in the CGRPs, and corporate Commonwealth entities (CCEs) are not required to comply unless they are delivering grants on behalf of a non-corporate Commonwealth entity (NCE). Regardless, entities are strongly encouraged to act in accordance with the CGRPs – particularly the key principles – in relation to all grants.

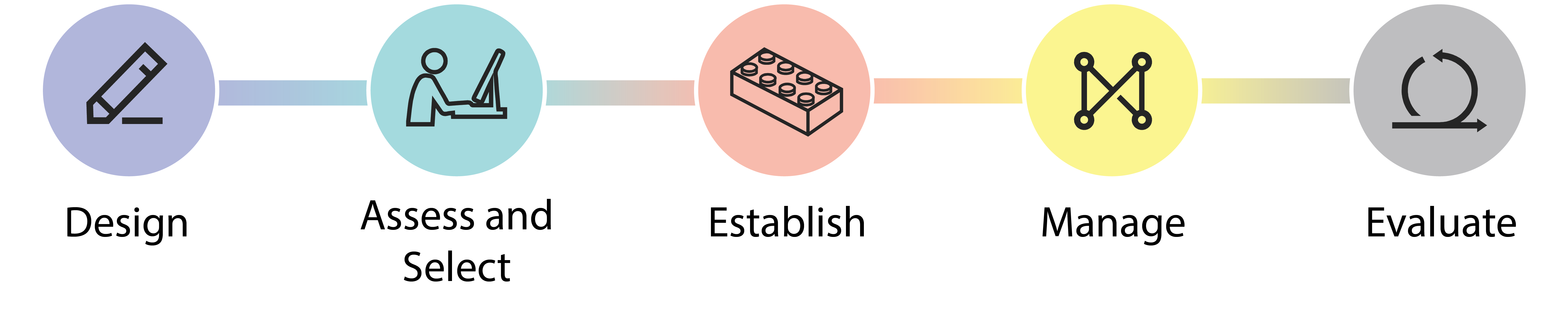

Grants Lifecycle

Grants administration encompasses all processes involved in the grants lifecycle including: the design of grant opportunities and activities; the assessment and selection of grantees; the establishment of grants; ongoing management of grantees and grant activities; and the evaluation of grant opportunities and activities. The objective of grants administration is to promote the proper use and management of public resources through collaboration with the non-government sector to achieve government policy outcomes.

Design

- defining objectives and desired outcomes

- establishing policy and legislative authority and securing funding

- developing the grant opportunity in collaboration with government and non-government stakeholders

- identifying and managing risks

- securing agreement to open the grant opportunity.

Assess and Select

- assessing grant applications for compliance with eligibility requirements, value for money and merit against selection criteria (where applicable)

- deciding who will receive the grant

- recording and reporting decisions.

Establish

- developing the grant agreement (where applicable) using the whole-of-government grant agreement template suite, and

- agreeing and executing the grant agreement with the potential grantee.

Manage

- monitoring grantee performance and compliance with the grant agreement

- managing risks and issues

- making payments under the grant agreement.

Evaluate

- assessing the performance of individual grantees against agreed performance indicators

- evaluating the grant opportunity against identified performance indicators and through consultation with stakeholders including those who benefited from grant activities

- determining if the government's desired outcomes were achieved.

Policy authority and funding

New or amended government spending activities need policy approval. This is often secured through the annual budget process or the Mid-Year Economic and Fiscal Outlook (MYEFO).

As part of the process of seeking policy approval for the proposed grant opportunity, officials need to identify the objectives and outcomes that the grant opportunity is intended to deliver.

The Australian Government gains the Parliament’s authority to spend relevant money through the passage of the annual Appropriations Acts and other legislation that establishes special appropriations.

Legal authority

Before entering an arrangement for the proposed commitment of relevant money like a grant, officials must ensure there is constitutional and legislative authority to support the arrangement, and a valid appropriation.

The Constitution limits the Commonwealth’s powers to spend money and enact legislation to authorise expenditure.

The legislative authority to enter, vary or administer an arrangement can come from either:

- specific legislation: new or existing primary legislation administered by the relevant portfolio that provides the Commonwealth with the power to enter into, vary or administer an arrangement. This authority may be delegated to officials to enable them to enter into, vary or administer an arrangement.

- section 32B of the Financial Framework (Supplementary Powers) Act 1997 (FFSP Act), used by the Commonwealth as source of legislative authority for Commonwealth spending. It provides authority through specifying activities in Schedule 1AA or Schedule 1AB to the FFSP Regulations.

- section 23 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act), which provides the Commonwealth with the power to enter, vary or administer an arrangement of relevant money that relates to the ordinary services and functions of government.

The Australian Government Solicitor provides advice on the Constitutional and legislative authority for the proposed expenditure.

In addition to the requirement for legal authority, accountable authorities and officials must act in accordance with the PGPA Act and Public Governance, Performance and Accountability Rule 2014 (PGPA Rule) and the CGRPs in relation to the proposed expenditure of relevant money.

In particular, section 15 of the PGPA Act requires accountable authorities to govern the affairs of the entity in a way that promotes the ‘proper’ use and management of the public resources the entity is responsible for, including through grants. ‘Proper’ means efficient, effective, economical and ethical. Accountable authorities achieve this through having appropriate policies, risk management systems, procedures, guidelines and internal controls in place, including relating to grants administration.

Developing grant opportunity guidelines

- Grant opportunity guidelines are the authoritative source of information about grant opportunities and must be developed and published for all new and revised granting activities, including one off ad hoc opportunities. The same requirement applies to grant opportunities where payments are being made through the states or territories to individuals, businesses or organisations.

- The CGRPs require accountable authorities and officials to have regard to the 9 key principles in the CGRPs when developing and administering a grant opportunity, including when developing grant opportunity guidelines.

- Grant opportunity guidelines are the authoritative source of information for grant applicants and other stakeholders. The size and complexity of guidelines should be proportionate to the size and complexity of the grant opportunity but should include all relevant information about the grant opportunity, including its purpose, how to apply the selection process that will be used, eligibility and assessment criteria and any requirements that successful grantees will have to meet.

- The CGRPs key principle ‘Consistency with grant guidelines and established processes’ provides best practice guidance about developing and using grant opportunity guidelines.

- Grant guideline templates are also available to help you develop grant opportunities in line with the CGRPs.

- Some Australian Government entities must use a grants hub to administer their grants, and others choose to do so. The Grants Hubs have design teams that help entities to design their grant opportunities to get the best outcomes. More information on the Grants Hubs is available below.

NCEs

NCE officials must develop grant opportunity guidelines for all new grant opportunities. Where changes are made to existing grant opportunities, they must also develop revised guidelines.

Where grant opportunity guidelines have been in place for a long period of time, officials should review the content and structure of the guidelines to ensure they are still consistent with the CGRPs and the relevant legislation.

NCE officials should ensure that grant opportunity guidelines align with the 9 key principles of the CGRPs and are written clearly to help potential grantees understand the opportunity. The guidelines should also communicate key information to potential grantees and at a minimum, provide them with enough information to submit a grant application.

Officials should consider testing the clarity of grant opportunity guidelines with government and non-government stakeholders prior to their release.

Before new or revised grant opportunity guidelines are published, entities must follow the process for the release of new and revised grant opportunity guidelines. More information on this process is available below.

CCEs

Under Division 6A of the PGPA Rule, CCE officials must develop written guidelines for CCE grants where the minister will be the decision maker for awarding grants. CCEs are also strongly encouraged to develop written guidelines for other grant opportunities.

At a minimum, CCE grant guidelines must include an explanation of the purposes, expected outcomes and objectives of the CCE grant; an outline of the application and assessment processes; and the entity’s operation and governance arrangements in relation to the CCE grant.

Where a CCE is undertaking grants administration on behalf of the Commonwealth, it is required to adhere to the key principles and applicable requirements of the CGRPs and to follow the process for the release of new and revised grant opportunity guidelines. More information on this process is available below.

Releasing new or revised grant opportunity guidelines

New and revised guidelines for all grant opportunities, including one off ad hoc grants, must be published on GrantConnect, unless the Minister for Finance has agreed to an exemption from this requirement.

Exemptions from the publication requirement are only available in limited circumstances and must be provided by the Minister for Finance (see paragraph 5.8 of the CGRPs). For more information, contact Finance at Grant Guidelines.

Ministerial agreement of the guidelines is generally required before guidelines can be published. In most cases, the relevant minister responsible for the grant opportunity can agree to the publication of the grant opportunity guidelines. In some cases, the agreement of the Minister for Finance will be required.

The Department of Finance reviews medium and high risk guidelines for their consistency with the CGRPs prior to their publication (except for guidelines relating to one off ad hoc grants). The review process also includes considering an assessment of the risks associated with the guidelines to determine whether the Minister for Finance needs to agree to their release.

This process is detailed in an Estimates Memorandum. For more information on the review process and to access the Estimates Memorandum and relevant templates, officials should contact their entity’s budget area or Finance at Grant Guidelines.

To support the review process, entities must undertake an analysis of risks associated with the grant opportunity and guidelines. The risk analysis considers a range of risks relating to the grant opportunity including risks relating to implementation, potential grantees and legal authority for the proposed spending activities. The risks will vary depending on the grant size and complexity, administrative and governance arrangements and potential stakeholder sensitivities.

Step 1

- Entities prepare grant opportunity guidelines and complete a risk assessment using the template in the Estimates Memorandum.

Step 2

- Entities provide the risk assessment, relevant legal advice and grant opportunity guidelines to Finance at Grant Guidelines.

Step 3

- For new and revised grant opportunities (other than one-off ad hoc grants and guidelines that have been agreed as low risk) Finance will review the guidelines to ensure they align to the CGRPs and provide feedback to the entity.

- Finance does not review one-off ad hoc grant opportunity guidelines or agree a final risk rating. However, entities must provide Finance a copy of the guidelines and supporting documents for new one-off ad hoc grants which pose a high risk.

- Finance does not review guidelines that have been agreed as low risk for consistency with the CGRPs unless the drafting entity requests a review. Finance will continue to review and determine the risk rating.

Step 4

- Finance and PM&C review and agree an overall risk rating for the grant opportunity.

- Treasury is also consulted for guidelines that relate to payments to the states and territories.

Step 5

- The relevant minister must seek the agreement of the Minister for Finance to release the guidelines (other than those relating to one-off ad hoc grants) in certain circumstances. Finance will advise the entity if this is required.

- Otherwise, and for one off ad hoc grants, the relevant minister (or appropriate delegate) can agree the release of the grant opportunity guidelines.

Step 6

- Once agreement to release is given, the entity publishes the grant opportunity guidelines on GrantConnect.

Implementing election commitments through grants

During an election campaign, government and non-government candidates may indicate they will provide certain funding, services or facilities if their relevant party is elected or re-elected to government. Implementing these election commitments may involve the making of a grant.

The Parliamentary Budget Office defines an ‘election commitment’ as:

A policy that a party has publicly announced and intends to seek to have implemented after the election. Election commitments that would have a material effect on the Australian Government budget estimates are included in the Election commitments report.

Officials must ensure that the award of a grant is consistent with the PGPA Act and PGPA Rule, in particular, the proper use and management of public resources, and the CGRPs.

The CGRPs are largely principles based and do not differentiate between proposed grants which come from an election commitment and any other grant proposal.

Election commitments for grant opportunities

When funding election commitments, entities need to consider whether it is appropriate to use an existing grant opportunity or program or if a new grant opportunity or program needs to be developed. A one-off, ad hoc grant may be appropriate in some cases if the criteria in paragraph 2.4c of the CGRPs are met.

If funding an election commitment through an existing grant opportunity or program it is important to consider whether doing so:

- might require an expansion of the existing opportunity by varying the grant opportunity’s eligibility and assessment criteria to meet the requirements of the election commitments.

- may reduce funding that would otherwise be available to other applicants under the program, and may lead to calls for the size of the program to be increased.

Existing grant opportunities or programs will already have established objectives, eligibility requirements and assessment criteria. The policy intent underpinning an election commitment may not be consistent with those objectives, eligibility requirements and assessment criteria and therefore may not satisfy these requirements for funding.

It may be appropriate to establish a separate grant opportunity for the purpose of administering election commitments.

Officials should consider proportionality (having regard for the policy objective of the grant opportunity) while developing processes and guidelines to ensure the decision maker has the capacity to demonstrate that funding decisions have been taken in accordance with the relevant statutory and policy requirements and achieve value with relevant money.

Officials have an important role to inform ministers of the grant opportunity and that any activities or projects that are likely to be funded as part of the opportunity are a proper use of relevant money.

Election commitment grant opportunity guidelines

Grant opportunity guidelines for election commitments must be developed and must comply with the relevant sections of Part 1 of the CGRPs.

The grant opportunity guidelines established for election commitments will advise proposed grantees:

- that funding can only be approved where the government is satisfied that the projects or activities would be an efficient, effective, economical and ethical use of relevant money

- of the factors that will be considered in making that determination (including as appropriate, the standards their project proposal will need to meet)

- of the obligations that proposed grantees will be expected to satisfy.

Developing grant agreements

Officials may need to develop a grant agreement to outline the terms and conditions under which a grant is awarded.

Grant agreements outline the relationship between an entity and a grantee and provide clarity, accountability and shared understanding between the granting entity and the grant recipient (Grantee).

Grant agreements should be well designed and use plain language to help both the entity and grantee understand the terms and conditions of an agreement.

When developing grants agreements, official should:

- Define the scope of the grant

- Clearly describe grant activities, objectives, intended outcomes and deliverables

- Detail the grant funding amount

- Include clear payment schedules

- Describe how and when funds will be paid

- Include eligible expenditure

- Establish reporting requirements

- include clear deliverables and performance expectations, and reporting requirements

- Clarify obligations, terms and conditions

- Only include additional terms and conditions if required

- Consider the impacts of any clauses on the grantee

- Include how the grant will be evaluated

- Including how the grantees performance will be assessed, if site visits are possible or if the granting entity may have access to records kept on the project

- Include relevant data the Grantee may be required to collect

- Include timeframes

- Include activity and agreement end dates

- Provide detail regarding if the agreement can be varied or extended

- Grant agreements should be proportionate to the risks and complexity of the grant activities. Officials should seek internal legal advice on the best form of grant agreement to use if unsure.

Part 2 of the CGRPs explains how to apply the key principles of grants administration and provides information on grant agreements.

APS officials should continuously communicate with grantees on the grant agreements, actively manage grants, and monitor performance based on the risks involved.

It is also important to track payments and progress, have risk management strategies and governance arrangements in place, and ensure funds provided to a grantee are used for their intended purpose.

Different templates and user guides for grant agreements are available in the Grants Toolkit, including a clause bank that has a range of additional clauses that may be used when required to suit the individual circumstances of the grant activity.

These templates can be used for grants and are designed for various situations, from low-risk to high-risk grants.

No single grant agreement works for all grants unless required by law or policy.

Officials should therefore choose a template based on a risk analysis and what is proportional for the purposes of the grant opportunity. Entities should also seek legal advice if needed to determine the right template for the grant activity.

If officials need to make changes to the templates, officials should consider seeking internal legal advice.

Finance does not need to approve additional clauses, but if templates are amended, let Finance know at Grants so we can review and update the templates if needed.

Finance does not provide advice on specific agreements or changes to clauses.

Caretaker

Refer to the Department of the Prime Minister and Cabinet for Guidance on Caretaker Conventions.

Due to the unique nature of grant opportunities, including their purpose, size, timing and sensitivity, there is no one-size fits all advice that can be provided on administering grants processes during a caretaker period.

Responsibility for observing caretaker conventions rests with the individual agency and responsible Minister and will depend on the specific circumstances.

Grants Hubs

This section outlines the role of the Grants Hubs in undertaking grants administration activities for certain entities. Grants Hubs help to deliver simpler, more consistent and efficient grants administration across government. The hub model reduces duplication of effort and costs across government by consolidating grants administration services, developing areas of expertise and improving user experience (making it easier for grant applicants and recipients to find and apply for grants).

There are two Grants Hubs - the Community Grants Hub and the Business Grants Hub. The Community Grants Hub is managed by the Department of Social Services and the Business Grants Hub is managed by the Department of Industry, Science and Resources.

The Hubs undertake grants administration processes for 15 in-scope entities that are:

- Attorney-General's Department

- Department of Agriculture, Fisheries and Forestry

- Department of Climate Change, Energy, the Environment and Water

- Department of Defence

- Department of Education

- Department of Employment and Workplace Relations

- Department of Health and Aged Care

- Department of Home Affairs

- Department of Industry, Science and Resources (DISR)

- Department of Infrastructure, Transport, Regional Development, Communications and the Arts

- Department of the Prime Minister and Cabinet

- Department of the Treasury

- Department of Social Services (DSS)

- Department of Veteran's Affairs

- National Indigenous Australians Agency

In-scope entities do not need to use the Grants Hubs for:

- new grant opportunities with 2-10 grant recipients where the total grant opportunity value does not exceed $1 million; or

- new grant opportunities where the government has agreed to a grant opportunity to provide a grant to a single specified recipient and the total value of the grant opportunity does not exceed $500,000; or

- grants made to international organisations and foreign governments; or

- research grants administered by the National Health and Medical Research Council or the Australian Research Council.

Deferring or seeking an exemption from the requirement to use a Grants Hub

In exceptional circumstances the responsible minister may write to the Minister for Finance to seek a temporary deferral or permanent exemption from the requirement to use one of the Grants Hubs to deliver a grant program.

A temporary deferral may be considered when:

- the funding for the grant opportunity is from a Special Account, or where delegation cannot be provided to the Grant Hub without legislative amendment or ministerial decision, or some other legal impediment exists

- the grant has a security classification higher than what the Hubs can support, or

- the technical complexity of the grant precludes Grants administration.

A permanent exemption will only be considered where it can be demonstrated that there are exceptional circumstances that cannot be overcome or resolved.

There are also other grounds for exemptions from using the grant hubs:

- if administering a grant opportunity through a hub would be disproportionately high compared to the value of the grant program, and the entity can demonstrate it can deliver in-house at a lower cost with no additional resources.

- where government agrees to a grant of more than $500,000 to a single, nominated recipient and Cabinet or the Minister for Finance has determined that grant delivery by an in-scope entity is appropriate due to concerns on cost or timeliness.

Evaluation requirements

Grants administration should be designed and implemented with all 9 key principles in mind however during the evaluate phase of the grants lifecycle, officials should focus on the principle an outcomes orientation. This principle focuses on achieving government policy outcomes. When determining whether a grant or group of grants have successfully met the policy outcomes appropriate evaluation methods need to be used.

Evaluation strategies

Evaluation strategies should be developed during the design phase of the grants lifecycle. Evaluation includes establishing appropriate performance measures on which to evaluate individual grants and the entire grant opportunity program.

An effective evaluation strategy should support the assessment of whether it is appropriate to repeat the grant opportunity and the grant's effectiveness – that is, whether the stated objectives have been achieved, and if there were any barriers to this success. Indicators of an effective grant opportunity should demonstrate which grant activities have made positive contributions to the outcomes of the grant opportunity as well as:

- if there would be a more efficient or effective way of achieving the government’s policy outcome(s)

- whether the government’s resources should remain allocated at current levels, be increased, be reduced or be discontinued.

Officials should ensure:

- outcomes, output and input measures are clearly specified in the grant opportunity guidelines

- performance measures are proportionate to the risk profile of the grant opportunity, grantees, and the grant activities being funded

- performance measures are specified in the grant opportunity guidelines; agreements; other documentation; and each entity’s broader performance management framework.

It is important that published grant opportunity guidelines, other guidance (if applicable) and the grant agreement clearly outlines the nature of information expected to be collected and reported by grantees as part of an evaluation. An effective strategy would identify the:

- performance measures

- performance indicators

- data sources intended to be used

- what methods will be used to analyse the data.

Conducting the evaluation

The evaluation of individual grants needs to be supported by effective reporting requirements, including performance measures, in grant agreements. Data collected from individual grantees can be important when assessing individual performance as well as evaluating the overall grant opportunity, or broader grant opportunity program. In this respect, it is important that entities take steps to ensure that grantee data has been presented on a comparable basis for analysis. This may be through standardised reporting systems, or analytical work undertaken in the entity. Officials must consider if data that can be sourced from other Australian Government entities is available.

Officials should consider alternative data sources to use for an evaluation such as statistics from the Australian Bureau of Statistics, other government data references (including state/territory data), or stakeholder data. Entities can use these data sources to determine if grant activities have achieved broader government policy outcomes.

Qualitative approaches (for example, case studies of individual grants), can also be useful to provide a deeper perspective into how the grant activities have assisted individual communities. Case studies can provide an in-depth perspective of the impact of grant activities in the community. Any case study must accurately illustrate the particular scenario.

Officials should apply the proportionality principle when determining the reporting and acquittal requirements for grants.

The proportionality principle should inform the conduct and reporting of grant opportunity evaluations. The evaluation should provide a balanced assessment which:

- focuses on the extent to which the government’s policy outcomes have been achieved

- details the context of the grant opportunity

- defines the validity and reliability of the evaluation data and methodology(ies) used

- discusses any challenges in conducting the evaluation

- links the analysis to the findings/conclusions and recommendations

- identifies whether the outcomes were in line with the expectations of the government, grantees and the entity.

For more information on best practice evaluation, visit the Treasury website to access the Commonwealth Evaluation Policy and RMG-130 Evaluation in the Commonwealth (Commonwealth Evaluation Toolkit). All queries relating to evaluation in the Commonwealth can be directed to Evaluation.