Department of Finance Corporate Plan 2018–19

Covering reporting period 2018–19 to 2021–22

Message from the Secretary

I am delighted to be leading a department that strives for excellence in delivering its purpose – to assist the Australian Government to achieve its fiscal and policy objectives through the Budget process and by advising on expenditure, managing sustainable public sector resourcing, driving public sector transformation and delivering efficient, cost-effective services to, and for, government.

As a central agency we have a privileged position from which to look to the interests of all citizens. Foremost is our responsibility to support the government to deliver its fiscal and policy objectives consistent with the Charter of Budget Honesty Act 1998, to create and manage financing structures, such as through government business enterprises, and to drive value in government spending.

This corporate plan sets out our approach and priorities for the next four years and the measures by which we will be held to account.

Leadership is vital for successful transformation. We aim to lead by adopting new and beneficial technology and business processes and to undertake earlier more structured and outcomes-based collaboration with clients and partners. Equally, we are embracing risk and enhancing the department’s risk management settings, improving the capacity of our teams to engage with risk in a structured and considered way.

As a champion of Australian Public Service (APS) modernisation, we continue to look for opportunities to improve how we operate. We need to be efficient and make use of new technology and opportunities for reforming our processes. We are investing in digital capability and process automation to streamline transactional business processes. This enables the department to focus even more on strategic and operational priorities.

As part of the ongoing transformation of the department, we are implementing shared services as a new and innovative way of working, recognising the benefits of operating at scale in the management of corporate functions, and continuously improving the capability of our teams to engage with the evidence and frame effective policy advice.

From a broader perspective, we have improved the corporate offerings to government agencies, for example through coordinated procurement arrangements which maximise the buying power of the Commonwealth, the continued rollout of shared services across Commonwealth entities, and by embracing data analytics to improve productivity and accountability.

We continue to invest in strengthening our relationships with stakeholders across the APS and the private sector. This is a reflection of the strong collaborative and solutions-focused approach that we see as integral to our ongoing effectiveness. We will continue to build new, constructive, enduring relationships to achieve positive outcomes across government.

We strive to provide assurance and strategic commercial advice to the Government on the delivery of major infrastructure projects through government business enterprises, driving innovation and managing risk across these complex projects.

We will continue to develop and enhance the enablers we need to deliver our priorities – resources, staff, capabilities, leadership, systems and business processes. In this way we seek to enable a modern responsive public service which operates as effectively and efficiently as possible to deliver government services and build a better Australia for all.

I am pleased to present the Department of Finance Corporate Plan 2018–2019.

Rosemary Huxtable PSM Secretary

Department of Finance

Introduction

I, Rosemary Huxtable, as the accountable authority of the Department of Finance, present the Department of Finance Corporate Plan 2018–19, which covers the period 2018–19 to 2021–22, as required under section 35(1)(b) of the Public Governance, Performance and Accountability Act 2013.

Purpose

Finance assists the Australian Government to achieve its fiscal and policy objectives by advising on expenditure, managing sustainable public sector resourcing, driving public sector transformation and delivering efficient, cost-effective services to, and for, government.

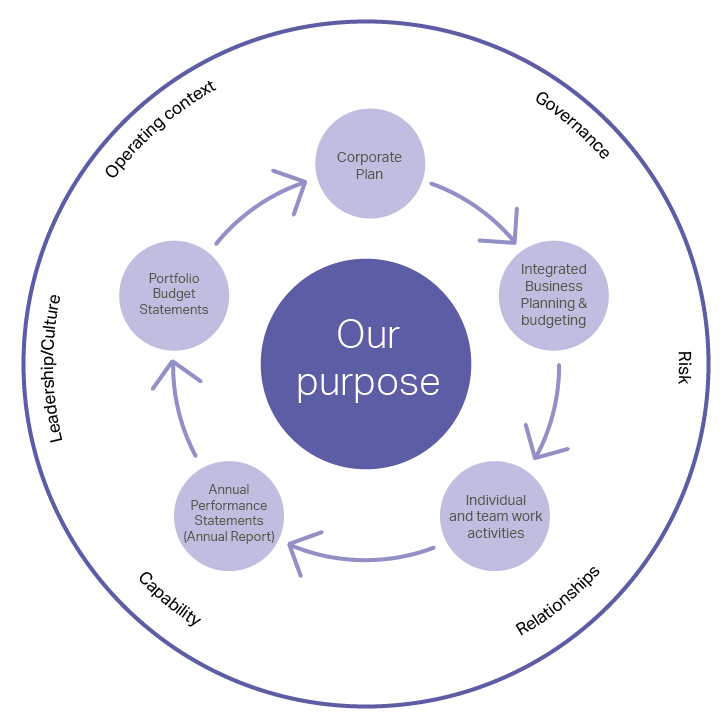

Finance’s Performance Reporting Framework

Finance has an integrated performance cycle and the corporate plan is our pre-eminent planning document. This is complemented by performance planning through our Portfolio Budget Statements and Annual Report, our Integrated Business Planning and budgeting processes, and governance processes that direct individual and team work activities to achieve our purpose.

Our performance in achieving our purpose is:

- informed by the operating context and the functions/roles allocated to Finance as a central agency

- supported by departmental strengths such as governance structures, risk policies, culture and organisational capabilities.

Figure 1. Finance’s performance cycle and environment

Roles and functions

The Department of Finance is a central agency of the Australian Government and plays a key role in assisting the Government to shape and deliver its priorities. We focus on ensuring public expenditure programs are effective, sustainable and reflect best value to government and the Australian community.

Our responsibilities are diverse, spanning the full range of public administration functions from the earliest points of developing policy through to implementing and reviewing programs.

To fulfil these responsibilities, we deliver an array of support and services including:

- providing policy and financial advice to the Minister for Finance, senior ministers and Cabinet’s Expenditure Review Committee on government expenditure and program delivery

- supporting the Government in its Budget preparation, delivery and ongoing management through the budget process

- providing leadership in the reform of the Australian Public Service, such as through the Public Service Modernisation Fund and by promoting public sector productivity, including by overseeing and delivering shared services (see Shared Services Program enhancing public sector efficiency case study)

- fostering leading public-sector practice through public-sector resource management, governance and accountability frameworks

- providing advice to the Government on optimal arrangements for construction, management and sale of public assets

- administering the government’s general insurance fund, investment funds and superannuation schemes

- managing the Government’s shareholdings in a number of government business enterprises and other public non-financial corporations

- providing a range of facilities and services to parliamentarians, their staff and former senators and members

- delivering whole-of-government information and communication technology services

- developing and maintaining the Government’s procurement policy framework

- managing the Government’s special claims, insurance and risk management operations

- administering discretionary compensation payments.

Shared Services Program enhancing public sector efficiency

Finance plays a key role in ensuring the public sector can deliver better services to citizens and businesses as efficiently as possible. This includes embracing technology and finding new ways of working so staff across the public service can be freer to work on the government’s highest priorities.

The Shared Services Program is a whole-of-government initiative transforming how the public service operates. It consolidates and standardises the delivery of corporate services through designated shared services hubs, helping agencies better deliver their core services.

The implementation approach that has been adopted for the Shared Services Program is informed by the experiences of, and lessons learnt, in other jurisdictions both in Australia and overseas. Consolidation and standardisation are underway. The Shared Services Program has mapped over 200 standard business processes which can be shared across the Commonwealth.

Finance is:

- responsible for the whole-of-government Shared Services Program

- operating the Service Delivery Office (SDO), one of the shared services provider hubs and

- transitioning our own corporate service functions to the SDO with a range of financial and HR services to be transitioned by mid-2019.

The transition of Finance’s corporate services to the SDO is expected to reduce the costs of delivering these functions by using defined and standardised services that are shared with other agencies. This will provide increased capacity for staff to focus on strategic business priorities; reduce time spent on manual transactional processes; and provide flexible technologies that can be tailored to meet business and policy requirements.

Our complementary role in implementing the Shared Services Program provides the opportunity to bring the policy and program elements of shared services closer together, enabling a feedback loop between delivery and policy/program design. This loop has proven valuable as Finance transitions its corporate service functions into the SDO’s shared services offering.

Finance continues to work collaboratively with government agencies to implement shared services. The Program is currently focussing its efforts on delivering a fit for purpose shared services solution for small agencies and taking a coordinated investment approach in common technology (platforms and software).

Under the Shared Services Program Finance is also operating a Productivity and Automation Centre of Excellence (PACE). The PACE offers government departments the ability to transform business and drive significant productivity gains through the provision of tools to support enhanced business management practices and process automation. The PACE has automated a number of shared service processes across the financial and HR operations of client entities which has increased efficiency and materially improved the quality of outputs while reducing costs to those entities.

Our Approach

Essential to achieving our purpose is early and proactive engagement with the entities responsible for implementing the Government’s policies and programs. Our views are also informed by ongoing dialogue with the other central agencies – the Department of the Prime Minister and Cabinet and the Treasury – as well as with the Australian Public Service Commission (APSC).

This engagement helps us to better understand and appreciate the issues and challenges our fellow agencies face. By building and sustaining trusted relationships, we help to ensure that all agencies share an understanding of the Government’s fiscal and other policy objectives.

Ultimately, it enables us to fulfil our responsibilities to:

- deliver more appropriate, practical and timely advice from a whole-of-government perspective

- develop more robust policy

- deliver better services and engage more successfully with our clients and stakeholders

- fulfil our role as a leader in enabling and driving reform in the APS.

We will continue to actively engage with agencies so we can further support them in developing and implementing policies, programs and projects that will benefit Australians. We want to fully appreciate the value of what they are trying to achieve and support them with informed, risk-based advice.

Along with this engagement, we will continue to appropriately embrace change and risk, and adopt modern business practices, to become increasingly agile and responsive to government needs. Underpinning all our work are the APS values of being impartial, committed to service, accountable, respectful and ethical.

Finance transforming the public sector

Finance is leading an Australian Government first, piloting a project to help transform and modernise the public service by digitising the development and publication of the Annual Reports of Commonwealth entities and companies.

This development will eventually help to standardise the collection and presentation of data and enable access to a wide variety of information across government. We are excited to be an early adopter of this transformational technology. We are working with more than 15 entities (including the Digital Transformation Agency) to co-develop the Digital Annual Reporting Tool.

We demonstrated a proof of concept for the tool to the Parliament’s Joint Committee of Public Accounts and Audit in late 2017. This proof of concept incorporated three years of retrospective annual report information from the departments of Finance and Prime Minister and Cabinet. It demonstrated how information in annual reports can be established as a dataset that is open for detailed scrutiny at the push of a button.

It is hoped that the pilot will demonstrate that annual reports can be more usefully and readily presented in a digital format. Digitised reports will make it easier for the Parliament and members of the public to search for, find and compare information across multiple reporting periods and entities.

It will also be more cost effective for government. More than 180 Commonwealth entities and companies produce hard copies of their annual reports, resulting in more than 25,000 copies of reports being printed each year. Digitising the process will reduce printing costs and environmental impacts.

In time, this solution may be expanded to capture other mandated reporting requirements, including corporate planning documents and other information presented to the Parliament.

Operating context

Finance has a clear purpose and a central role in government yet the environment in which we operate is challenging, complex and uncertain.

In assisting the Government to make informed decisions consistent with its fiscal and other policy objectives, we need to account for this complex operating environment. Australia’s changing demographics, for example, provide a range of policy challenges from the sustainability of retirement income through to the need for adequate infrastructure investment. The relationships between citizens and governments at all levels are also evolving, including rising expectations on governments.

Australia’s closer integration with the rest of the world brings its own challenges and opportunities, as do rapid technological advancements.

The work we do in Finance is both cyclical and unpredictable. As well as managing the scheduled Budget cycle, we must also respond at short notice to developing issues and unexpected events – both nationally and globally – and provide independent advice to support the Government’s fiscal strategy.

Australian citizens and businesses expect high-quality and easily accessible government services, delivered in real time and at low cost. To provide the best value for taxpayers’ money, we and the entire public sector must meet these expectations in the most effective and efficient way.

Embracing the challenges

To ensure success in this environment and remain responsive to government, we lead and innovate. Our internal transformation is strengthening our position as a recognised leader in the Government’s drive to make the APS more efficient and productive.

We have already become a modern and agile agency with a more mobile, creative and capable workforce that can adapt and respond faster to changing priorities, risks and challenges.

This internal transformation is gaining momentum as we implement new, clearer departmental priorities and more effective business tools. We are also adopting relevant technologies and building stronger external relationships through earlier and more structured engagement.

An example of this is the development of the Parliamentary Expenses Management System (PEMS) in response to a Government decision that improvements to the entitlement system were required to better support Parliamentarians and their staff and meet public expectations. This fully integrated, online, digital system will better support the administration, audit and reporting of work expenses for Parliamentarians and staff employed under the Members of Parliament (Staff) Act 1984. This will drive efficiencies and increase transparency of parliamentary expenses which will be available to the public through monthly reporting.

The initial PEMS release was delivered on time on 2 July 2018 allowing users to begin exploring the system. Further releases will take place through 2018 and 2019 with final reporting functions due to be operational in early 2020.

Environmental factors

Table 1 sets out the areas of focus arising from our purpose statement as well as the environmental factors that may impact or influence their delivery over the four-year period of the corporate plan.

Table 1: Environmental factors 2018–19 – 2021–22

| Areas of focus | Environmental factors |

|---|---|

|

Advising on expenditure |

|

|

Leadership in the public sector |

|

|

Delivering effective services to, and for, government |

|

Secretaries APS Reform Committee

Finance is strengthening its role as an innovative leader and driver of transformation, both internally and across all of government, to help ensure the public sector delivers better services for citizens and business as efficiently as possible. Our aim is to continuously improve and to be a model of public sector reform.

The Finance Secretary chairs the Secretaries APS Reform Committee which works on behalf of the Secretaries Board to drive initiatives that will have an immediate and positive impact on citizens and business, while also ensuring public sector administration is delivering the best value it can. Some initiatives will provide inputs for the Independent Review of the Australian Public Service, which is focussed on long term reforms through to 2030.

The Committee’s work is underpinned by reform principles of delivering high quality outcomes, building and maintaining trust through engagement, harnessing new ideas and applying innovative methods and technology.

As part of our whole-of-government stewardship role, we collaborate across 19 entities on delivering projects to modernise the public sector to implement the Committee’s ongoing roadmap for reform. Under the roadmap, the Committee is overseeing 24 new projects which complement the 42 Public Sector Modernisation Fund projects already under way.

We have direct responsibility for 15 projects that the Committee is overseeing, including delivering a Process Automation Centre of Excellence, making better use of data to deliver policy and program insights through our Government Business Analytical Unit (see Government Business Analytical Unit implements a data-driven approach case study) and working with agencies to coordinate investment in ICT platforms and software as part of the Shared Services program (see Shared Services Program enhancing public sector efficiency case study).

These broader reforms are mirrored in our own internal transformation, which includes, among other things, our ongoing transition to shared services arrangements.

Transforming how we engage with risk

As part of Finance’s transformation, we are continuing to embed a positive risk culture throughout the department to drive productivity and ensure the effective and efficient use of public resources.

This means we are taking a more open and proactive approach to managing risk that considers both opportunities and threats. It is a more mature way of embedding systematic risk management into business operations. It will enable us to identify, assess and consult on risk across the department and with others in relation to shared risk.

A key enabler of this approach is increasing the risk capability at all levels of the organisation. To achieve this we are educating and empowering our people to have the knowledge, judgement and confidence to make more informed risk-based decisions. We are also ensuring they have the support of their managers.

This approach will also see our people engaging with risk in ways that are consistent with our risk appetite, which we regularly review and which is, in turn, aligned with Finance’s purpose.

We are confident that more risk-based decision making will make our business better – more efficient, agile and responsive. But we also know that we need to continuously improve. To this end we are developing measures so we can build, test and refine our approach. These measures will complement our integrated business planning and will assist us to better understand how we prioritise our resources.

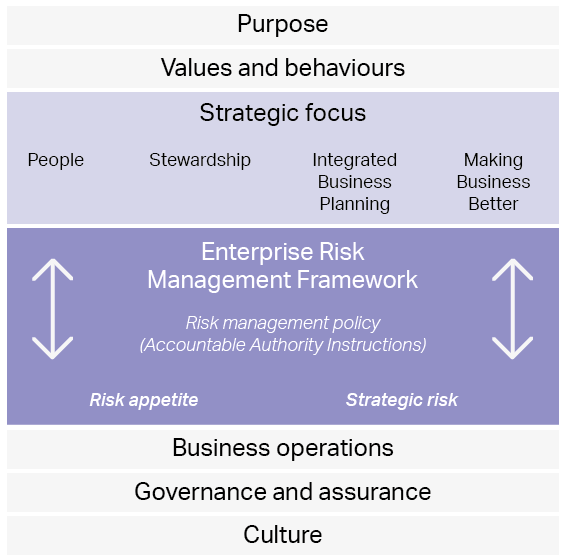

Our approach to managing risk

We manage risk in accordance with the Commonwealth Risk Management Policy and our department’s Enterprise Risk Management Framework. The framework sets out our policy and guides the identification, management and reporting of risks where they may impact our business at the strategic and operational level.

Figure 2 – Our approach to managing risk

The framework is subject to regular and structured review. In 2017-18 we reviewed our framework to strengthen its alignment with our purpose and strategic focus for transformation.

The risk appetite statement and our key strategic risks maintained within the framework have been updated. These updates recognise that we operate in a dynamic environment and our ability to manage risk directly impacts on how we achieve our purpose.

In 2018-19 we will be embedding these updates into our business operations. This will strengthen our risk management capability as we educate and empower our people at all levels to make more informed risk-based decisions. It will also support our broader transformation within a positive risk culture.

Our risk oversight

Finance’s Executive Board, including the Secretary, has overarching responsibility for the ongoing endorsement of the Enterprise Risk Management Framework.

Responsibility for key strategic and operational risks is assigned to individual senior executive officers. A central risk function in Finance supports business areas in their day to day work.

Risk management oversight is also incorporated into departmental governance arrangements at the project and activity level. This includes oversight of shared risk that Finance manages with other entities, such as the clients of our Service Delivery Office or projects relating to our shareholder role in government business enterprises.

Finance’s executive governance committees are responsible for reviewing and guiding the management of risks relating to their responsibilities. In particular the Risk Sub-committee is responsible for ensuring Finance has an effective framework in place and the necessary capability to manage its risks. The Audit Committee is responsible for reviewing the appropriateness of the system of risk oversight and management.

Our risk appetite

We articulate our appetite for engaging with risk, exploring opportunities and making risk-based decisions through a risk appetite statement. The statement is an important way to define our culture and is aligned to our purpose.

Risk Appetite Statement

To meet the Australian Government’s fiscal and policy objectives, the Department of Finance carefully considers risks and opportunities in its complex and changing operating environment.

Risks and opportunities do not manifest themselves in isolation. To fulfil its stewardship role effectively, the department must consider shared risk, opportunity and innovation together when undertaking projects and activities.

The department’s risk appetite informs and guides its decision making and plays a central role in shaping a culture which embraces change and opportunities in promoting the effective and efficient management of public resources.

We assess our appetite to accept risk by using a scale of enhanced, balanced and limited. This determines the way we categorise and treat a risk in respect of policy development, project delivery and decision making. This approach supports us to make more informed and consistent risk-based decisions. If a risk exceeds our appetite, we escalate it and treat it through corrective actions.

Figure 3: Our levels of risk appetite

| Risk appetite | Description | Treatment |

|---|---|---|

| Enhanced | Risk management is less constrained by process to encourage innovation | Greater risk is accepted to support new ways of doing things |

| balanced | Risk management is balanced to pursue opportunities to innovate | Measured risk is accepted to grow the business |

| Limited | Risk management involves active mitigation against additional risk exposure | Risk is reduced to the lowest acceptable level |

Our key strategic risks

Finance has identified nine key strategic risks that, were they to eventuate, may affect our ability to operate and achieve our purpose. We manage these risks through mitigating controls and treatment strategies that focus on the investment in our people, stakeholders and systems.

Figure 4: Key strategic risks

| Strategic focus | Strategic risk |

|---|---|

| Stewardship | 1. Finance does not meet the expectations of Government with regard to the provision of relevant, timely and considered advice. 2. Finance fails to clearly develop and implement its stewardship role (leading, guiding and influencing) in modernising and transforming the public sector to achieve Government fiscal and policy objectives. 3. Effective governance frameworks are not established to support the successful implementation of complex projects and activities led by, or involving, Finance. 4. Finance’s ability to collaborate internally and operate as a connected organisation impacts our ability to provide excellence and value to stakeholders and government in a resource constrained and dynamic environment. |

| Integrated Business Planning | 5. Finance fails to drive the transformation and cultural change required to assist the department to achieve its strategic purpose and priorities and drive innovation. |

| People | 6. Finance’s investment in and management of its people does not meet short-term or long-term capability requirements to support the individual, department and broader public service to achieve its strategic purpose and priorities. 7. Finance does not maximise productivity through staff engagement, particularly in relation to the management of staff wellbeing and capability, talent management and staff agility. |

| Making Business Better | 8. Finance’s business processes are not designed to realise measurable benefits and opportunities in a shared services and shared risk environment. 9. Finance fails to effectively govern and manage data, reducing opportunities to better use information and increasing its exposure to targeted, intentional or accidental disclosure. |

Figure 5: Key risk mitigation strategies

| People | Stewardship | Integrated Business Planning | Making Business Better |

|---|---|---|---|

| Finance’s ability to drive productivity and promote innovation is dependent on our people and culture. We invest in our people and culture through defined leadership behaviours and people management frameworks that focus on capability uplift, mobilisation and flexible working arrangements to ensure staff engagement at all levels. | Finance’s central agency role involves maintaining strategic partnerships with our clients and stakeholders, including through citizen-facing activities. We are defining and implementing our governance structures to collaborate, share knowledge and develop solutions with a focus on shared risk outcomes. | Finance collaborates internally and operates as a connected organisation. We are systematically prioritising work and allocating resources through integrated processes that consider Finance’s operating model and risk profile as a whole. | Finance optimises opportunities to improve our business in a resource constrained environment. We are strengthening our ability to govern and manage data by embedding new systems and practices that support evidenced-based decision making and improve public sector policy through enhanced data analytics and data management. |

Capability/enablers

Capability/enablers

We help to lead the APS reform agenda and drive transformation across the public sector. Central to this is how our internal activities support better services for citizens and businesses and are delivered in the most efficient ways possible. To help achieve this, we are transforming and strengthening our capabilities and enablers.

This transformation journey began in 2015-16, by focussing on people, place, technology and information. Projects under these themes were introduced to enable us to better serve the government and the Australian people. They have helped to improve how we prioritise and resource work, and modernise our tools and systems.

These enhanced capabilities are making us more agile and adaptable, and more effective in strengthening the capability of the APS (as well as our own department’s employees) to deliver sound policy advice and public administration.

Enhancing capability across the APS

We initiated the Graduate Certificate in Public Policy in 2016 to build capability in public finances and public policy and generate an improved understanding of the fiscal environment and the Australian Government Budget Framework.

The Graduate Certificate was co-designed by the Department of Finance, Department of the Prime Minister and Cabinet, Department of the Treasury, Department of Education and Training and the Institute for Governance and Policy Analysis at the University of Canberra.

It is different from other policy or finance courses, partly because it has been collaboratively designed. Each year, technical experts share their practical experiences with course participants, explaining how the APS operates and making clear the relationship between theory and practice. So far, 60 APS employees have graduated from this program—a strong reflection of the department’s commitment to strengthening public sector workforce capability in this area.

We are also building capability to more effectively fulfil our oversight role of Commonwealth Government Business Enterprises (GBEs). We are focussing more on GBE policy and promoting our stewardship role, bringing together key stakeholders (including the states, territories and GBE company secretaries) to share knowledge and experience.

We need to better understand the financial models and economic drivers of GBE businesses. To do this we are continuing to build our skills by recruiting business analysts and engaging accredited providers to design and deliver tailored training on financial analysis, governance and risk. These programs will be made available to other shareholder departments, further improving the APS’s skills and capabilities.

Aligned with this is our trialling of engaging private sector experts to provide support and mentoring to staff overseeing the delivery of major GBE projects. We believe this will strengthen the skills and capabilities of those overseeing and advising GBEs.

Another example of how we are enhancing capability across the APS is by managing and operating the Government Business Analytical Unit (see Government Business Analytical Unit implements a data-driven approach). This unit will enable more data to be used to inform public sector policy and government administration so Commonwealth agencies can share, integrate, analyse and report protected government data securely.

Government Business Analytical Unit implements a data-driven approach

Finance hosts the Government Business Analytical Unit (GBAU), a unit established under the Data Integration Partnership for Australia (DIPA), to focus on increasing the use of data to inform public sector policy and government administration.

DIPA was formed in 2017-18 as a cross-agency investment in the Australian Government’s data integration and analytics capacity. Analytical hubs have been established under the DIPA in several agencies to investigate cross-portfolio policy issues affecting health and welfare, education, the environment, the economy, business and industry and government business. The GBAU focuses on increasing the use of data to inform public sector policy and government administration.

The Government Business Analytical Unit is part of the Public Sector Transformation Division and consists of five ongoing data analysts recruited from across the APS.

Since being established in late 2017 the GBAU has been working with Finance’s Information and Communications Technology Division to build the Secure Information Sharing Capability (SISC), a DIPA-funded data asset that will allow sharing, integration, analysis and reporting of protected government data between Commonwealth agencies.

The unit has secured funding for two DIPA analytical projects to be carried out in 2018-19 in partnership with the APSC. One of these projects is informing policy development in the APS Reform work program by assessing drivers of productivity across the public sector as well as measuring the efficiency of selected transactional services. The second project will integrate workforce information held by Finance and the APSC to provide insights into workforce management and planning and to reduce entities’ reporting burden.

The GBAU also developed and received approval for a project under the National Innovation and Science Agenda’s 2018-19 Platforms for Open Data program. It is working with the National Archives of Australia and Data61 to create a dataset that will allow government users, researchers and the public to analyse information linked to government functions over time, taking into account Machinery of Government changes.

The GBAU has also been working with other branches within Finance on a range of internally-focused projects. For example, the unit is collaborating with HR Branch to bring insights from the annual APS Census on the attributes of high performing teams. This will assist us to apply this understanding to all the teams in the department as well as to inform the Finance Transformation Program.

A further example of how Finance is building capability across the APS is through the development of GovTEAMS, a new whole-of-government digital collaboration service (see GovTEAMS facilitating collaboration across the APS). GovTEAMS will replace GovDex and will provide Government employees and their industry partners with a modern collaboration environment through which they can connect, interact and coordinate work efforts across organisational and geographical boundaries.

GovTEAMS facilitating collaboration across the APS

Finance is using an agile approach to design, develop and evolve GovTEAMS, a new platform that is driven by and responsive to user needs.

GovTEAMS is the replacement for GovDex, the APS-wide collaboration platform managed by Finance for over 10 years. GovTEAMS will provide Government employees and their industry partners with a modern collaboration environment through which they can connect, interact, and coordinate work efforts across organisational and geographical boundaries. This will help drive public sector productivity and innovation.

The core capabilities of GovTEAMS include:

- Real-time collaboration – members will be able to connect, share and work together using document sharing, real-time document co-authoring and instant messaging

- Online profiles – members will be able to easily discover each other and work together by searching persistent profiles detailing the skills, experience and interests of each member.

- Discoverable communities – members who administer a community will have the option of an open, semi-private, or private community. The level of access will determine the visibility of the community to other members who might want to be involved.

- GovTEAMS will be hosted in a cloud environment that is certified for official information, up to Unclassified with a dissemination-limiting marker (such as For Official Use Only).

We have also been making our workforce increasingly mobile and agile, by promoting flexible work practices supported by relevant technology and collaborative work spaces, which has helped—among other things—to develop an innovative ‘surge’ model.

This model involves training employees across the department for temporary deployment to priority business areas experiencing peak demand. It significantly increases efficiency in internal and APS-wide operations. The model has proved extremely successful, with surge teams deployed to support Finance’s role in three federal Budgets, the 2016 general election and the Central Budget Management System redevelopment project. In 2018-19 we are continuing to enhance this capability for use in the general election that will occur in this financial year.

The surge model benefits the department as well as our people’s professional and personal development, and helps us retain talented employees for longer. Our approach to surge – and broader mobility – is evolving so that we can draw on the extensive skills and experience of all staff and provide a range of opportunities.

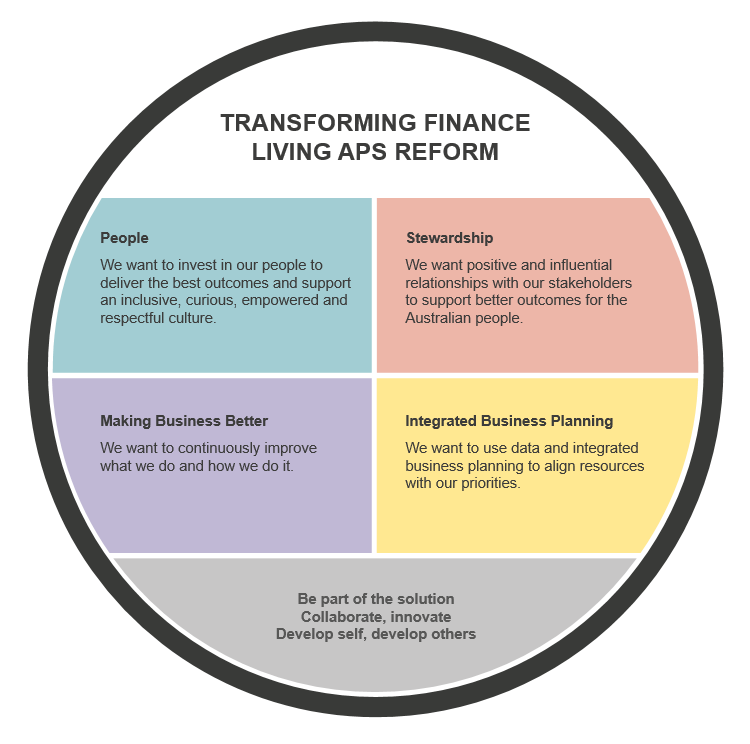

Improving further in 2018-19

Our transformation continues in 2018-19, sustained by embedding a culture of continuous improvement. This is seeing us review what we do and how we operate and calculate how we can improve. We continue to ‘build-test-refine’ our approach and in 2018-19 we are focusing on four areas that have evolved from our 2015-16 themes:

People: We want to have an inclusive, curious and empowered culture, aligned to priorities and capable of seizing opportunities presented by change

Stewardship: We want positive and influential relationships with our stakeholders to support better outcomes for the Australian people

Making Business Better: We want to continually challenge what we do, how we do it and act on improving

Integrated Business Planning: We want to make timely and informed decisions using better data and integrated planning, budgeting and reporting

We know that a culture that facilitates innovation and allows all staff to contribute to their full potential produces better outcomes.

Our leadership expectations guide how our staff, at all levels, will contribute to our culture.

- Develop self, develop others – no matter what your classification, a foundational element of leadership is reflecting on your strengths and areas for development and investing time and effort to improve. Of equal importance, especially when you become responsible for managing others, is investing in developing the staff around you. This starts with honest and constructive feedback and is an ongoing process. Investing in ourselves and our people will help us to build our culture and grow as an organisation.

- Be part of the solution – everyone is encouraged to work together for shared outcomes. If you notice something that needs to be addressed, help create the solution. Take a positive approach to your work by looking to understand and overcome challenges that you come across in your daily work.

- Collaborate, innovate – this is about how we approach our work. The outcomes we work towards are increasingly dependent on the contribution of others. In this environment, we will achieve our greatest success through innovating and working together.

Strategic Review guiding our work

In 2017-18 we initiated an Executive Board Strategic Review as part of our Integrated Business Planning approach. The Strategic Review provides a regular, comprehensive picture of our priorities, risks and constraints, enabling us to reallocate funding most effectively and focus on improving our processes and systems.

Themes that we are focussing on as a result of the May 2018 Strategic Review support the four Focus Areas – People, Stewardship, Making Business Better and Integrated Business Planning – and include:

- Organisational alignment, workforce planning and resourcing – aligning our work to reflect government priorities and supporting a flexible and empowered workforce in line with the APS Optimal Management Structures framework.

- Strategic partnerships – building better and earlier-stage partnerships across the APS, with academia, think tanks and the corporate sector to help us strengthen our capabilities and increase our ability to influence, develop solutions and deliver outcomes.

- Long term policy thinking – a greater focus on policy thinking so that we can provide the best strategic advice to government and build our long-term policy capability.

- Workflow and quality control – looking at our processes including levels of approval, systems and the technology we use for workflows to ensure they are efficient and delivering the most effective outcomes.

- Making the most of our technical capabilities – building technical capabilities in data analytics, digital literacy and data visualisation, accounting, procurement and business analytics and sharing those capabilities across the department.

- Self-service – building a better understanding among our stakeholders to maximise the benefits of self-service and recognising that this takes time and effort.

- Knowledge management – having a framework to harness the value of our information, data and corporate knowledge. This is critical to managing risk, supporting consistency, building capability and working more efficiently.

The Strategic Review is the key mechanism to identify priority areas and allocate resources accordingly. It will also hold us accountable for our progress and assist in identifying new improvement initiatives.

Our staff informing our future One of the most significant, beneficial and rewarding achievements in our ongoing transformation has been the enhanced engagement with our people. As well as making our teams more mobile, agile and capable, we have also put our people at the centre of the direction-setting processes.

Our people are experts in their specific areas and in how Finance works as a department, what succeeds and what fails, and what can and should change. Through opt-in sessions and other staff discussions we sought their views on high-level elements such as understanding our mission and over-the-horizon policy thinking and more practical elements such as business process improvements, security and their own aspirations and goals.

The engagement has also led directly to:

- a new monthly Security Forum to discuss departmental security arrangements

- a new project to develop a department-wide knowledge management framework

- changes to streamline the travel approval process online

- a review of mobility opportunities for staff, including creating an opportunities register

- a strategic partnership engagement plan

- a new capability framework and implementing strategies under the Workforce Plan.

This enhanced engagement has also empowered our people by demonstrating the value of their experience and ideas. Also, because they are now part of developing Finance’s transformation, they can better understand why we are doing it and what roles they play.

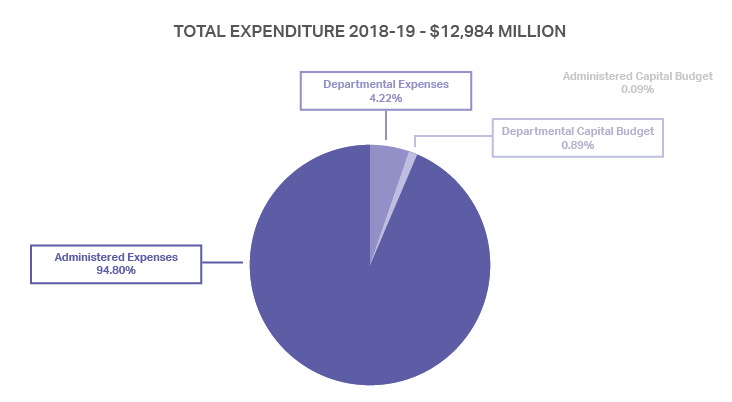

Our financials

Finance has a total departmental expense budget of $547.6 million in 2018-19. Finance’s departmental capital budget is $115.0 million, of which $6.5 million relates to ordinary capital acquisitions, with the balance relating to major and minor projects primarily in the Property Special Account.

Finance has a total administered expense budget of $12,309.3 million in 2018-19 and an administered capital budget of $12.2 million.

Further information regarding Finance’s budget estimates (departmental and administered), Average Staffing Levels and financial statements for the reporting period is set out in the Finance Portfolio Budget Statements 2018–19.

Figure 6. Total Expenditure 2018-19

Performance

We are continuously strengthening the performance information we provide to the Parliament and the broader community. Our 2017-18 Corporate Plan reflected this commitment and featured a new and improved performance framework.

The performance framework provides performance information on the three key themes of our purpose:

- advising on expenditure

- public sector resources and transformation

- delivering effective services to, and for, government

The framework details how our performance will be measured by identifying:

- key activities that we undertake under each of these three themes

- performance criteria which reflect the main outcomes we want these activities to achieve

- goals for each of these performance criteria so that achievement against performance criteria can be assessed

- methodologies to monitor results and track overall progress.

The performance framework provides substantial detail regarding how Finance’s progress in achieving its purpose will be measured.

In the 2018-19 Corporate Plan we are building on this performance framework to support analysis of our performance over time. We are doing this by maintaining existing performance information where appropriate and, where changes have taken place, identifying these changes under a new element of the performance framework under ‘changes since 2017-18 Corporate Plan’.

In this Corporate Plan we have a suite of 26 performance criteria for the reporting period 2018-19 to 2021-22 with:

- 16 existing performance criteria that are unchanged or only marginally changed to improve the clarity of the performance information

- 5 performance criteria that have been updated to reflect the evolution of the related work activities

- 4 new performance criteria related to significant emerging activities being undertaken during the reporting period

- 1 performance criterion, from page 23 of our 2017-18 corporate plan “governance and assurance are effective in supporting accountable authorities meet their obligations under the Public Governance, Performance and Accountability Act 2013 (PGPA Act)”, which was discontinued as the activity to which this performance criteria relates is being measured by other ongoing performance criteria.

Table 2: Performance information for period 2018-19 to 2021-22

| ADVISING ON EXPENDITURE | ||||

|---|---|---|---|---|

| Activity | Performance criteria | Assessed as | Methodology | Changes since 2017-18 Corporate Plan |

|

Coordinate, prepare and advise the Minister for Finance and Expenditure Review Committee of Cabinet on the delivery of the Budget and related fiscal updates, including appropriations legislation and the government’s financial statements, to contribute to promoting the government’s fiscal target and policy objectives. |

Budget papers, related updates (e.g. the Mid-Year Economic and Fiscal Outlook) and Appropriation Bills are accurate, delivered within required timeframes and meet the government’s fiscal and policy objectives and legislative obligations. |

Budget papers and related updates are produced in accordance with the timeframes and other requirements of the Charter of Budget Honesty Act 1998. Appropriation Bills are introduced into Parliament at times intended by government and in accordance with legislative requirements. Budget estimates are based on external reporting standards and any departures from external reporting standards are identified, consistent with requirements set out in the Charter of Budget Honesty Act 1998. Budget estimates are accurate (taking into account, to the fullest extent possible, all government decisions and other circumstances that may have a material effect) and explanations are provided where variances are equivalent to or greater than: 2 per cent difference between first forward year estimated expenses and Final Budget Outcome for first forward year. 1.5 per cent difference between budget estimated expenses and Final Budget Outcome for budget year. 1.0 per cent difference between the revised current year estimates at Mid-Year Fiscal Outlook and final budget outcome for the current year. 0.5 per cent difference between the current year estimates at budget time and Final Budget Outcome for the current year. 1.5 per cent difference between budget estimated expenses and Final Budget Outcome for budget year. 1.0 per cent difference between the revised current year estimates at Mid-Year Fiscal Outlook and final budget outcome for the current year. 0.5 per cent difference between the current year estimates at budget time and Final Budget Outcome for the current year. |

Demonstrated by tabling dates of Budget papers, related updates and Appropriation Bills recorded in the Hansard. Program estimates are reviewed and updated to take account of the best available information to maximise their reliability and accuracy. Budget papers and related updates outline the external reporting standards used and identify any departures from that standard. Significant differences between the estimated expenses and final outcome are explained and reported annually. |

Nil |

|

The government’s financial statements, including monthly statements, are complete, accurate and released publicly on timeframes agreed with the government. |

Monthly financial statements prepared within an average of 21 days of the end of the month for which they are prepared following the release of the Final Budget Outcome. Consolidated financial statements are provided to Auditor-General by 30 November of each year. Audit opinion issued by Auditor-General in relation to the consolidated financial statements. |

Date of correspondence to Minister for Finance providing monthly financial statements. Date of correspondence providing consolidated financial statements to the Auditor-General. The Auditor-General issues an unmodified audit report on the consolidated financial statements. Measured monthly and reported annually. |

This performance criterion has been edited to include the Auditor-General’s audit opinion as a further measure of performance. |

|

|

Daily disbursement through the Central Cash Management System so that entities can deliver on the policy objectives of the government on necessary timeframes. |

Commonwealth entities have access to cash on a daily basis. |

The cash needs of each and every Commonwealth entity is met for each and every day of the 2018–19 financial year. |

CBMS and Reserve Bank daily data transmission records can be used to demonstrate that the payment runs have been completed each day with drawdowns available to agencies. Measured daily and reported annually |

This criterion has been edited to remove the words “Parliament making cash” available every day. |

| PUBLIC SECTOR RESOURCING AND TRANSFORMATION | ||||

|---|---|---|---|---|

| Activity | Performance criteria | Assessed as | Methodology | Changes since 2017-18 Corporate Plan |

|

Working with partners across government to implement and support projects funded by the government’s $500 million modernisation fund to help establish a more efficient, adaptable, productive and sustainable public sector. |

Finance oversight of Modernisation Fund investment ensures government has visibility of progress and outcomes, and informs government decisions around prioritisation and ongoing management of investments to drive improved outcomes. |

Finance provides advice to the APS Reform Committee and the Minister for Finance on project performance and ongoing management of investments within parameters agreed by government. Finance coordinates and disseminates case studies to support sharing of better practice and lessons learnt. Projects that do not deliver benefits are ceased or re-scoped. |

Quarterly project status reports provided to the APS Reform Committee. Advice on project performance and ongoing management of investments is provided to the APS Reform Committee and to government to inform decisions, including where appropriate for the Mid-Year Economic and Fiscal Outlook and Budget processes. |

Changes to this criterion reflect the establishment of the Secretaries APS Reform Committee which has strategic oversight of the Modernisation Fund. Finance supports the Committee in undertaking this role. |

|

Corporate service functions (e.g. financial, human resources and associated IT systems) for non-corporate Commonwealth agencies are provided through a shared services provider hub arrangement, on common platforms and software. |

Evidence of uptake of shared service arrangements for non-corporate Commonwealth entities. Evidence of increased efficiency in delivering corporate service functions within shared services provider hubs. Reduction in the number of individual Enterprise Resource Planning systems across Hubs, through coordinated investment in platforms and software. |

Progress is measured continuously using information collected from shared services provider hubs. Progress is measured through maturity assessments undertaken by shared services provider hubs. Costs avoided through common investment in platforms and software across the Hubs. |

Changes to criterion reflect the ongoing evolution of the Program and the Modernisation Fund’s specific contribution to the Program as a whole. |

|

|

Entities currently participating in the whole-of-government grant administration arrangements must implement existing and proposed in-scope grant activity via the Government’s Community and Business Grants Hubs using the Hubs’ standardised grant process and ICT grants management services, replacing the multiple ICT systems and business processes currently in operation. |

By 30 June 2019, around 86 per cent of grants will be delivered through the hubs (up from the 74 per cent estimated in the 2017-18 Budget). |

Progress is monitored quarterly, as per transition schedules agreed by the grants hubs and consuming entities. |

The increase in grants delivered through the hubs reflects changes to implementation schedules, as negotiated between the maturing hubs and consuming entities. |

|

|

Finance participation in the Data Integration Partnership for Australia contributes to an increase in Commonwealth public sector analytics capability and use of data to inform public policy. |

Evidence of improved ability to share data between Commonwealth entities. Evidence of data analytics contributing to public sector reform. |

Datasets available to authorised users for analysis through the Secure Information Sharing Capability. Completion of a pilot project measuring drivers of productivity and efficiency of selected transactional activities across Commonwealth entities. |

Changes to the criteria reflect Finance’s specific projects and the expected benefits of these projects, which have now been agreed under the Data Integration Partnership of Australia. |

|

|

Supporting the APS Reform Committee, a subcommittee of the Secretaries’ Board, to deliver activities that will modernise the public sector |

Finance oversight of activities under the Modernising the Public Sector Roadmap supports better services to citizens and businesses, delivered more efficiently – to build trust in government. |

Roadmap activities are delivered across six streams of work: Productivity; Citizen and Business Engagement; Structure and Operating Model; Investment and Resourcing; Policy, Data and Innovation; and Workforce and Culture. Projects across each stream are implemented according to the Implementation Plan and Change Management, Engagement and Communication Plan, with progress and benefits reported to the APS Reform Committee. A positive shift in public sector performance against metrics developed through the Productivity Pilot. |

Implementation status reports provided for the APS Reform Committee meetings. Six monthly reports by the Chair of the Committee to the Digital Transformation and Public Sector Modernisation Committee of the Cabinet. Measurement of performance against pilot metrics, through the Government Business Analytical Unit. |

This new performance criteria has been included in Finance’s 2018-19 Corporate Plan to demonstrate Finance’s support of the newly established APS Reform Committee in delivering activities that will modernise the public sector. |

|

Support the proper use of public resources by Commonwealth entities and companies under the Commonwealth Resource Management Framework. |

Finance ensures the Resource Management Framework is maintained as fit-for-purpose framework for the proper use of public resources, under which Commonwealth entities and companies understand their governance and accountability obligations, and are equipped and supported to meet them. |

Survey of entities to measure entity awareness of their obligations under the PGPA, the implementation of the PGPA and the effectiveness of the support and guidance provided by Finance. |

A survey of Chief Finance Officers across all Commonwealth entities and companies on:

Questions will be framed and responses analysed in a manner consistent with accepted market research practice. Conduct and report on survey in 2017–18 and subsequent years. |

This performance criteria has been edited in respect of Finance’s role in maintaining the framework for the proper use of public resources. |

|

The government and key Parliamentary committees have confidence that public resources are used efficiently, effectively, economically and ethically. |

ANAO reports and JCPAA consideration of these reports do not include adverse findings on the PGPA Act and associated rules. |

Monitor all ANAO reports tabled in Parliament each financial year and JCPAA reports, and assess findings relating to the PGPA Act and associated rules. Measured continuously and reported annually. |

This performance criteria has been edited to include the considerations of the JCPAA as an additional evidence source. |

|

|

The PGPA Act and Rule provisions, and Finance’s support services, enable achievement of the objectives of the PGPA Act. |

Finance implements Government response to the recommendations of the independent review of the PGPA Act and Rule quickly and effectively, including through co-ordination with others where required. |

Finance to support a timely Government response on the report’s recommendations (within 6 months of receipt of final report), with an indicative implementation timetable and allocation of responsibilities established in this period. Periodic progress reports to Finance Minister, JCPAA and other stakeholders and their assessment and feedback. |

This performance criteria has been edited to reflect that Finance’s role has moved from supporting the independent review in 2017-18 to implementing the recommendations of the review from 2018-19 forward. |

|

|

Implement and support the enhanced Commonwealth performance framework as a means to improve planning and accountability to provide meaningful information to the Parliament and the public (Section 5(c)(ii) of the PGPA Act 2013). |

Better performance information is available to the Australian Parliament and the public. |

ANAO reports and JCPAA consideration of these reports confirm that published performance information is improving in its quality and insightfulness. Annual analysis of corporate plans and annual performance statements identify an increasing number of Commonwealth entities and companies are demonstrating better practice. |

As determined from the recommendations and key findings of ANAO reports on published corporate plans and annual performance statements. JCPAA views on the quality of performance information will be determined by analysing its findings on various ANAO reports. Increasing number of entities display better practice as determined by Finance’s qualitative analysis of corporate plans and annual performance statements each financial year. Measured and reported annually. |

Nil |

|

Provide a policy, regulatory and legislative framework that enables the Future Fund Board of Guardians to maximise the returns on investment funds. |

Investment mandates are set for each Australian Government Investment Funds which assist in achieving the financial and risk objectives and are consistent with the policy, regulatory and legislative framework. |

Investment mandates for the managed funds issued by the Australian Government are met. |

Based on quarterly portfolio updates published online by the Future Fund Management Agency. Measured and reported on a quarterly basis. |

This performance criteria has been edited to draw a clearer link between the achievement of investment mandates and the activity/objectives of the investment funds. |

|

Provide a policy, regulatory and legislative framework that facilitates the efficient and effective administration of civilian superannuation arrangements for members of parliament and Commonwealth entities. |

The Commonwealth government’s civilian superannuation schemes are effectively administered. |

The operational objectives for the administration civilian superannuation schemes regarding benefit payments, pension and contributions processing, and the despatch of members’ statements are met. |

Based on performance updates published by the Commonwealth Superannuation Corporation. Measured continuously and reported on an annual basis. |

This new performance criteria has been included in Finance’s 2018-19 Corporate Plan to cover Finance’s contribution to the administration of civilian superannuation arrangements for members of parliament and Commonwealth entities. |

|

Leverage experience and influence of the Australian Government to achieve value for money procurements. |

Finance works with external stakeholders to develop, implement and maintain systems and policies to support a fair, efficient, and transparent procurement framework for the Australian Government and its suppliers. |

Finance advisory services, forums, training, and other support mechanisms are well attended or utilised. AusTender data is made available to enable analysis of market sector participation. Regular engagement with domestic and international stakeholders supports information exchange on advances in procurement policy. |

Measured and reported annually via data and feedback collected from various sources such as:

|

In 2018-19 the ‘assessed as’ field for this criteria has been edited to include AusTender data is made available to enable analysis. |

|

Whole-of-Australian-Government (WoAG) procurement arrangements for non-ICT corporate services (e.g. travel bookings and major office equipment) generate savings for Commonwealth entities that access these arrangements. |

The total nett value of annual savings as a result of WoAG procurement arrangements reported by Commonwealth entities. |

Savings are based on volume and pricing, compared where possible against similar arrangements or markets. These are calculated when the arrangements are created, extended or refreshed. |

Nil |

|

|

Provision of a self-insurance fund (Comcover) to protect Commonwealth entities against insurable losses and support them to manage risk. |

Comcover is financially sustainable |

An appropriate balance between capital efficiency and low premium volatility is achieved with the government’s requirements for a self insurance fund being met. |

Claim liabilities are fully funded and Comcover maintains adequate reserves to meet its outstanding claims provision. |

In 2018-19 the methodology for this criteria has been edited to include Comcover maintaining adequate reserves to meet its outstanding claims provisions. |

|

Comcover assists Commonwealth entities to ensure the appropriate treatment of insurable risks and provides a consistent, whole-of-Australian-government approach to the management of claims against the Commonwealth. |

Stakeholder satisfaction with the professionalism, skills and service provided. Litigation is undertaken honestly and fairly as a model litigant. |

Evaluation of feedback from Commonwealth entities and key stakeholders. Risk and education services evaluated and reported annually. Comcover’s approach to claims management aligns with the Commonwealth’s Model Litigant Obligations. |

In 2018-19 the methodology for this criteria has been edited to include alignment of Comcover’s approach to claims management with Model Litigant Obligations. |

|

|

Deliver on the government’s policy of delivering savings through the National Property Efficiency Program and the National Divestment Program |

In accordance with government targets:

|

Property efficiencies delivered through the whole-of-Australian Government (WoAG) property services coordinated procurement arrangements (leasing and facilities management). Proceeds from divestments are returned to the Budget and savings delivered through the reduction in ongoing property management and maintenance costs. Ensure the newly established online Australian Government Property Register remains an accurate source of all Commonwealth land holdings and assists in identifying those landholdings that could be considered surplus to requirements. |

Through the annual Australian Government Office Occupancy Report and monitoring of contractual arrangements for WoAG providers. Regular review of the data assurance and entities’ sign-off requirements surrounding property data collections given its validity is a key component for delivering the National Property Efficiency Program. |

In 2018-19 this performance criteria has been edited to include better utilisation of office space within the criteria. |

|

Engage with Government Business Enterprises (GBEs) and shareholder departments to facilitate financial sustainability and sound governance arrangements for all GBEs. |

Facilitate and monitor GBE delivery of the government’s key infrastructure priorities, including Western Sydney Airport, Inland Rail and Naval Shipbuilding. |

Ensure that GBE and project governance is fit for purpose including establishment of governance documents such as statements of expectations, commercial freedom frameworks and funding agreements. Timely reporting to ministers and government on progress. Proactive reporting on emerging issues. |

GBE corporate plans are analysed and provided to shareholder ministers, with GBEs to publish their Statement of Corporate Intent by 31 August each year. Finance measures GBE performance against a standard set of key performance indicators, outlined in quarterly reports. GBEs publish an annual report detailing their performance. Governance arrangements are reviewed at various stages of delivery of infrastructure priorities. |

In 2018-19 an additional methodology has been identified for this criteria, review of governance arrangements. This review will complement the other methodologies by providing information about whether the governance arrangements are fit for purpose. |

|

Continue to encourage ongoing efficiency and financial sustainability in GBEs. |

GBEs operate efficiently, maintain a commercial focus and manage the longer-term financial and operational sustainability of the entity, including the payment of dividends in accordance with agreed corporate plan targets. GBE corporate plans comply with GBE guidelines and provide sufficient information to permit performance and financial reporting and monitoring. |

Quarterly and annual strategic reporting and meetings with shareholder departments and the relevant GBE. Targeted strategic reviews by shareholder departments to ensure GBEs operate as efficiently as possible. |

In 2018-19 annual strategic reporting has been added to the quarterly strategic reporting methodology. |

|

| DELIVERING EFFECTIVE SERVICES TO, AND FOR, GOVERNMENT | ||||

|---|---|---|---|---|

| Activity | Performance criteria | Assessed as | Methodology | Changes since 2017-18 Corporate Plan |

|

Provide services to Commonwealth entities as one of five shared service hubs established by the government to drive efficiencies in back-office administration functions. |

As a Shared Service hub, the Service Delivery Office provides quality services to client entities. |

Service level agreements with client entities are met. The benefits of consolidation and optimisation of shared service corporate functions will be assessed by:

|

The Service Delivery Office’s (SDO’s) seven service level agreements contain service standards to be met as measured through the recording of SDO enquiries and transactions. The measures enable analysis of service levels on a monthly basis and are provided to the SDO’s clients on the 20th day of each month. The benefits of consolidation and optimisation will be measured through the increase in:

The above measures will be monitored on a monthly basis and reported annually. A summary report will also be shared with the SDO’s governance committees. Measured continuously and reported annually. |

The number of service level agreements identified in the methodology for this criteria has reduced from nine in 2017-18 to seven in 2018-19. This was a result of an annual review of the Service Catalogue conducted by the Service Delivery Office as part of its 2017-18 Business Plan. The review identified updates to the Service Level Outcomes (SLO) for services provided to client entities including the removal of two of the previous year’s SLOs. The SLOs were removed as they were duplicates and/or did not reflect actual service offerings. |

|

Undertaking ICT development projects to support the modernisation of the APS. |

Commonwealth entities and companies have access to GovTEAMS, a new generation platform to provide a single environment for both internal and external collaboration across government to improve public sector productivity. |

The GovTEAMS platform is successfully operating with all the modern collaboration tools such as Chat, Online Audio and Video Meetings, Online Profiles, Social Feeds, and File Sharing available to government employees and their invited external guests for 99 per cent of the time in office operating hours. The following user adoption rates are achieved: The existing 18,000 active Govdex users adopt GovTEAMS in 2018-19. |

Uptime statistics at the GovTEAMS platform demonstrate the platform is available for 99 per cent of the time in office operating hours. Monitoring the number of users that have registered on the GovTEAMS platform. Monitoring the number of existing Govdex users that have adopted the GovTEAMS platform. At least one case study from 2018-19 and onwards to demonstrate the productivity benefits for users of using the GovTEAMS platform. Utilising the GovTEAMS business case to model the annual productivity benefits of using the GovTEAMS platform. Measured continuously and reported annually. |

These two new performance criteria have been included in Finance’s 2018-19 Corporate Plan to demonstrate Finance’s contribution to the modernisation of the APS through undertaking ICT development projects. |

|

Commonwealth entities and companies have access to the GovCMS management and website hosting support platform to assist in the creation of modern, affordable and responsive websites that better connect Government with people. |

The GovCMS platform is available to entities seeking to develop and maintain websites 99 per cent of the time in office operating hours. Reduced net operating costs of websites after migrating to GovCMS. |

Uptime statistics at the GovCMS platform https://www.govcms.gov.au/dashboardwill be monitored daily to determine the availability of the platform. Monitoring the number of websites and number of entities that have active GovCMS subscriptions. At least one case study from 2018-19 and onwards to demonstrate the benefits of creating and operating a website through GovCMS. Reporting annually on website hosting and administration costs for sites using GovCMS by:

Measured continuously and reported annually |

||

|

Provide a range of services to Parliamentarians, their respective employees and others required by the Australian Government to assist them in undertaking their duties. |

Services meet the needs of Parliamentarians, their employees and others as required by the Australian Government. |

The following service standards are met or exceeded:

|

KPIs are measured monthly and progress reported to Executive Board. Achievement of success is reported annually via the targets in Outcome 3 of Finance’s Portfolio Budget Statement. A stakeholder survey will be undertaken in late 2018-19, subject to the effective introduction of Parliamentary Expenses Management System. Measured continuously and reported annually. |

In 2018-19 an additional methodology has been identified for this criterion: undertaking a stakeholder survey. This stakeholder survey will complement the other methodologies by providing data regarding whether the services are meeting the needs of Parliamentarians, their employees and other clients. |

|

The timeliness, efficiency, clarity and transparency of the administration of parliamentary work expenses is improved. |

New system developed to deliver parliamentary expenses and services. |

Progress is measured continuously and reported annually from quarterly progress reports provided to the Executive Board. |

In 2018-19 the methodology for this performance criterion has been expanded. The development and delivery of a new system for parliamentary expenses and services will provide additional data for inclusion in the progress reports to the Executive Board. |

|

Download

Copyright

© Commonwealth of Australia 2018

ISSN 2206-7299 (online)

This publication is available for your use under a Creative Commons BY Attribution 3.0 Australia licence, with the exception of the Commonwealth Coat of Arms, the Department of Finance logo, photographs, images, signatures and where otherwise stated. The full licence terms are available from http://creativecommons.org/licenses/by/3.0/au/legalcode

Use of the Coat of Arms

The terms under which the Coat of Arms can be used are set out in the Commonwealth Coat of Arms Information and Guidelines on the Department of Prime Minister and Cabinet website (see https://www.pmc.gov.au/resource-centre/government/commonwealth-coat-arms-information-and-guidelines).